- Space Dirt

- Posts

- January's Space Dirt 🚀 (mid-month)

January's Space Dirt 🚀 (mid-month)

Where commercial real estate meets hard tech

Happy New Year!

Turns out, the hard tech industry never takes a break, even during the holidays.

The real estate market stayed busy with Impulse Space securing 139,500 SF in Redondo Beach, Pacific Fusion opening a 200,000 SF manufacturing center in New Mexico, and Firehawk Aerospace expanding into Mississippi with 636 acres for rocket production.

On the funding front, Hadrian hit a $1.6B valuation, Radiant raised $300M+ for nuclear reactors, and Cambium announced a $100M Series B.

All that, plus a whole lot more.

Let's go.

-Erik

REAL ESTATE HIGHLIGHTS

Impulse Space leased 139,500 SF at 3650 Redondo Beach Ave, Redondo Beach, CA. (source: Me!)

Momentus subleased (from QuantumScape) 61,100 SF at 1762 Automation Parkway, San Jose, CA. (source: Me!)

Pluto Aerospace leased space at 3000 Kent Ave, West Lafayette, IN. (source: LinkedIn)

The Oklo Aurora powerhouse. (Image: Oklo)

Oklo Inc, an advanced nuclear technology company, announced an agreement with Meta Platforms that advances Oklo’s plans to develop a 1.2 GW power campus in Pike County, Ohio, to support Meta’s data centers in the region. The agreement provides a mechanism for Meta to prepay for power and provide funding to advance project certainty for Oklo’s Aurora powerhouse reactors deployment. Oklo will use the funds to secure nuclear fuel and advance Phase 1 of the project—supporting the development of clean, reliable power in Pike County that can scale up to 1.2 GW. Meta’s commitment enables Oklo to pursue development in southern Ohio. Oklo seeks to develop the project on 206 acres of land in Pike County owned by the company and formerly owned by the Department of Energy. The land purchase was facilitated in part by the Southern Ohio Diversification Initiative (SODI), a nonprofit working to reuse the land for regional development. (source: Oklo)

Anthro Energy has formally selected Louisville, KY, to establish the first large-scale, U.S.-owned and operated Li-ion battery electrolyte facility, creating over 500 jobs to drive innovative energy manufacturing in Kentucky. Anthro was awarded a $24.9 million grant from the US DOE Manufacturing & Energy Supply Chains Office (MESC) and an additional $18.4 million in investment tax credits under the second round of the Inflation Reduction Act’s (IRA) 48C Qualifying Advanced Energy Project Tax Credit program. This new facility will scale Anthro’s manufacturing footprint, producing up to 25 GWh of Anthro Proteus™ Electrolyte production capacity. (source: LinkedIn)

Firehawk Aerospace acquired DCMA-rated integration facility in Crawford, MS with a 20-year lease on 636 acres to significantly expand rocket manufacturing capacity. The Dallas-based defense technology company (specializing in advanced energetics and propulsion using 3D-printed propellant) will use the facility for full-rate production of end-to-end rocket systems. The acquisition supports addressing urgent defense challenges, including rebuilding munition inventories drawn down faster than they can be replaced. The move continues momentum from Firehawk's previously announced 340-acre propellant and motor production facility in Lawton, Oklahoma (source: Firehawk Aerospace)

Pacific Fusion launched the Los Lunas Build Center in New Mexico to manufacture components for its $1 billion Mesa del Sol research and manufacturing campus. The California-based nuclear fusion company opened the 200,000 SF facility in Los Morros Business Park (formerly the Merrillat cabinet factory) to produce components for its demonstration system, targeting net facility gain by 2030. The build center expects 100 full-time employees by the end of 2026 and will manufacture 156 modules for the demonstration system by the end of 2027. The Mesa del Sol campus construction begins in 2026, with operations expected by 2027. Pacific Fusion raised $900+ million in Series A funding in 2024. (source: ABQ Journal and news-bulletin.com)

Joby Aviation announced plans to double U.S. manufacturing capacity to support production of four aircraft per month in 2027. The Santa Cruz-based electric air taxi company will expand production at its Marina, CA, facility and Ohio operations. Joby has disclosed $1+ billion in potential aircraft and service sales and is working with Toyota Motor Corporation to finalize a strategic manufacturing alliance. The company completed an expanded manufacturing facility in Marina in July 2025 and began propeller blade production in Ohio in October. (source: Joby Aviation)

Antares’ new Idaho Falls office has some unique history. (image: Costar)

Antares opened an Idaho Falls office, which sits inside the historic Rogers Building — the original Idaho Operations Office of the U.S. Atomic Energy Commission. The office is located at 545 Shoup Ave, Idaho Falls, ID. Antares recently announced a $40 million strategic partnership with Idaho National Laboratory to build its first two test reactors and develop a test facility. The Idaho Falls office will drive local operations and support INL collaboration. Antares is investing in a 200-acre campus for nuclear reactor testing needs. (source: Post Register)

STEALTH NO MORE

Diffraqtion emerged from stealth with a $4.2 million pre-seed round to build quantum cameras for space applications. The Massachusetts-based startup combines quantum imaging with AI to capture high-resolution imagery of distant objects or achieve the same clarity with much smaller lenses. Led by QDNL Participations, the round included milemark•capital, Aether VC, ADIN, and a $1.5 million DARPA SBIR Direct-to-Phase 2 contract. CEO and co-founder Johannes Galatsanos says the technology can deliver analytics at "the speed of light" - providing insights in seconds rather than hours. The company plans to build 6U cubesats with 10cm lenses for $500,000 that match the resolution of large Vantor satellites, and larger cameras rivaling Hubble Space Telescope capabilities for "a couple million dollars" on 50kg spacecraft. Rather than delivering traditional images, the quantum cameras output data and analysis directly. Timeline: 2027 ground-based Space Domain Awareness (SDA) operations, 2028 first launch for orbital SDA capabilities, 2029 Earth observation services. The technology promises to dramatically reduce costs while maintaining high resolution - particularly valuable for national security applications requiring rapid decision-making. (source: Payload)

GRU Space (YC W26) emerged from stealth, accepting $1 million in deposits for lunar hotel reservations targeting a 2032 opening. Founded in 2025 by Skyler Chan (22, UC Berkeley EECS graduate), the company develops off-planet habitats using in-situ resource utilization (ISRU) technology to turn lunar regolith into building materials. Chan became an Air Force-trained pilot at 16, worked on vehicle software at Tesla, built a NASA-funded 3D printer launched into space aboard Virgin Galactic, and authored at the world's largest space conference (IAC 2025). The company is backed by investors from SpaceX and Anduril, participates in Nvidia's Inception program, and features founding technical staff, including Dr. Kevin Cannon (former Ethos Space CTO, Colorado School of Mines professor) and advisor Dr. Robert Lillis (Principal Investigator, NASA Mars ESCAPADE mission on Blue Origin's New Glenn). Three-mission roadmap: 2029 demo mission turns lunar regolith into bricks and demonstrates modular pressurized habitat system; 2031 mission deploys larger inflatable structure in lunar pit/cave; 2032 mission opens first lunar hotel (Earth-built inflatable module for up to 4 guests, 10-year operational life, offering moonwalks, driving, golfing). Long-term master plan: build America's first Moon base (roads, mass drivers, warehouses), repeat on Mars, own property as space economies grow, achieve "Galactic Resource Utilization" across Moon/Mars/asteroids. Hotel designed like San Francisco's Palace of the Fine Arts, progressively hardened with lunar brick structures. (source: Y Combinator, Payload)

AxionOrbital Space (YC W26) emerged from stealth, building foundation models for 24/7 Earth observation by converting Synthetic Aperture Radar (SAR) data into high-resolution optical imagery. Founded in 2025 by Atharva Peshkar (Co-founder & CTO, ex-Harvard, CS PhD @ CU Boulder) and Dhenenjay Yadav (Co-founder & CEO, ex-IIMA, ex-ISRO, reinforcement learning enthusiast, former esports player, built UAVs). The San Francisco-based company solves the critical visibility gap where legacy optical satellites are useless 70% of the time due to weather and night cycles. Their proprietary ORION model uses deterministic one-step diffusion to transform complex radar signals into photorealistic images, achieving FID score of 30.24 (beating current SOTA C-DiffSET by 19.23% on MSAW benchmark) and SSIM score of 0.60. SAR-to-optical conversion enables continuous monitoring through clouds, smoke, and darkness at 1/100th the cost of current tasking. Applications include hedge fund/HFT alpha generation, defense situational awareness, agricultural crop monitoring, and urban planning. The technology aims to replace passive optical satellites as the primary mode of Earth observation, reducing hardware congestion in Low Earth Orbit while enabling 24/7 planetary monitoring. The company has built a cloud-based no-code platform for accessing and analyzing planetary-scale satellite data, designed to simplify geospatial development workflows. (source: Y Combinator)

Terra Industries emerged from stealth with a $11.75 million seed round led by 8VC to build Africa's first modern defense prime. The Abuja, Nigeria-based company was founded in 2024 by Nathan Nwachuku (CEO, 22) and Maxwell Maduka (CTO, 24) to develop autonomous security systems for critical infrastructure across Africa. Nathan represented Nigeria in the Physics Olympiad and built an ed-tech platform serving hundreds of thousands at age 18. Maxwell served as a UAV engineer in the Nigerian Navy at 18 and founded a drone startup at 19 (later acquired). Other investors include Valor Equity Partners, Lux Capital, SV Angel, Leblon Capital, Silent Ventures, Nova Global, and angel investor Micky Malka. Alex Moore (8VC Defense Partner and Palantir Board Director) joined Terra's board. The company operates a 15,000 SF manufacturing facility in Abuja, with 40% of engineers having served in the Nigerian military. Products include long/mid-range drones, sentry towers, unmanned ground vehicles, and maritime systems powered by proprietary ArtemisOS software. Terra has generated $2.5+ million in commercial revenue protecting assets valued at $11+ billion (hydroelectric plants, mines) and secured its first federal contract. The funding will expand manufacturing across Africa and open software offices in San Francisco and London while keeping production on the continent. (source: 8VC)

NEW MAP COMING SOON

I’m updating my SoCal Hard Tech Landscape map and will release it in the next Space Dirt. If you're a hard tech company that should be on the map, DM me your company name and city.

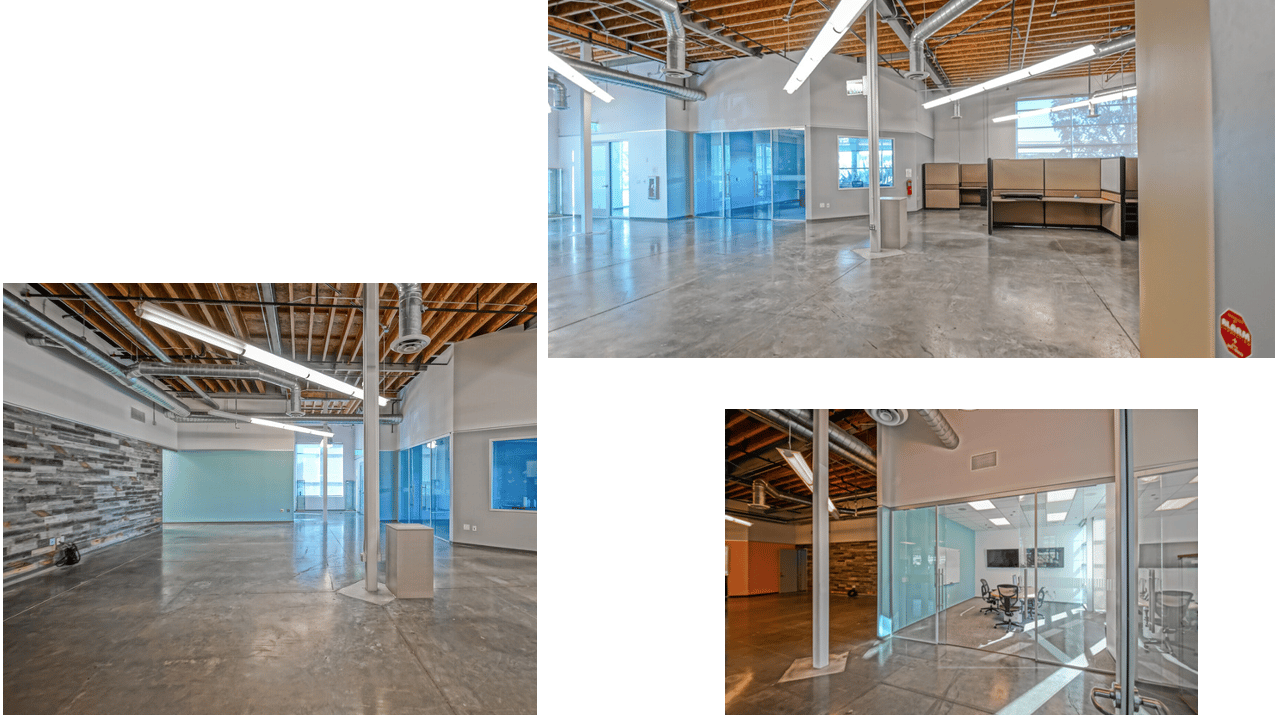

SUBLEASE OPPORTUNITY IN EL SEGUNDO

If you’re in the market for a hard tech flex sublease, check out the photos and details below. Clean space that’s move-in ready. Reach out for a tour or more info.

Address: 887-889 N Douglas St, El Segundo, CA

RSF: 7,369 (quick breakdown: 1 office, 2 conference rooms, 1 kitchen, 1 large open space for desks, lab space with a garage door; space is fully HVAC)

Rent: $3.75 per SF, Modified Gross

Term: Through August 31, 2027

Available: 60 days

Parking: 30 unreserved spaces at no cost

Power: 625 Amps; 240-480V

887-889 N Douglas St, El Segundo, CA (image: Costar)

Interior pics of the 887-889 N Douglas St sublease opportunity. (image: Costar)

NOTABLE FUNDINGS

Hadrian has raised expanded capital led by accounts advised by T. Rowe Price Associates. Hadrian said the financing values the company at $1.6 billion. The round included participation from Altimeter Capital, D1 Capital Partners, StepStone Group, 1789 Capital, Founders Fund, Lux Capital, a16z, Construct Capital, and existing investors, according to the company. Hadrian said it will use the new funding to accelerate factory expansion, scale workforce training programs, and continue investing in automation, AI-driven tooling, and real-time manufacturing intelligence. The company’s model, which it describes as “Factories as a Service,” is aimed at producing mission-critical components, assemblies, and full product lines with higher throughput and reliability as demand for domestic capacity increases. (source: Pulse 2)

Radiant raised more than $300 million in a new round of funding to mass-produce nuclear reactors. This latest capital raise, coming just six months after closing its Series C, will support the scaling of commercialization efforts as it prepares to break ground early next year on its R-50 factory in Oak Ridge, Tennessee. This round was led by Draper Associates and Boost VC. As part of this latest capital raise, Radiant also received additional investment from DCVC, Washington Harbour Partners LP, Align Ventures, a16z, ARK Venture Fund, StepStone Group, Giant Ventures, Founders Fund, IQT, Friends & Family Capital, Chevron Technology Ventures, and others. (source: LinkedIn)

Onebrief, the operating system for modern command, today announced it closed a Series D, featuring both a primary and secondary offering for an aggregate of $200 million. The round was held at a post-money valuation of more than $2 billion, and was led by Battery Ventures and Sapphire Ventures, with new participation from Salesforce Ventures and additional investment from General Catalyst and Insight Partners. This round will help Onebrief scale rapidly and strengthen the platform’s position as the foundation for command operations — integrating planning, wargaming, simulation, and live decision support into one unified ecosystem. Proceeds from the Series D round will be used to expand Onebrief’s AI Assist product and ensure wartime resiliency. (source: Onebrief)

JetZero announced it has raised approximately $175 million in its Series B financing, led by B Capital, a global multi-stage investment firm. United Airlines Ventures, Northrop Grumman, 3M Ventures and RTX Ventures, the corporate venture capital arm of RTX, among others, also participated in the round. To date, JetZero has raised and secured commitments of more than $1.0 billion, including government grants, incentives and commercial commitments. The new capital will accelerate the development of JetZero’s full-size Demonstrator, a prototype designed to achieve at least 30% improved aerodynamics compared to traditional tube and wing aircraft. The Demonstrator is on track for its first flight in 2027. (source: JetZero)

Cambium announced a $100 million Series B financing led by 8VC, with participation from MVP Ventures, Lockheed Martin Ventures, GSBackers, Veteran Ventures Capital, J17 Ventures, Vanderbilt University, Alumni Ventures, Gaingels, Inevitable Ventures, JACS Capital, Jackson Moses, and other individuals and family offices. This funding will accelerate both Cambium's product pipeline and materials manufacturing in the U.S. and Europe, supporting customers across aerospace, defense, energy, marine, motorsport, and other high-performance sectors. (source: PR Newswire)

UK-based renewable energy firm Fuse Energy has raised $70 million in fresh funds to expand internationally and advance the introduction of new products. The Series B was led by Balderton and Lowercarbon Capital. The fundraising transaction has given the business a valuation of $5 billion. In particular, the funds will allow the company to expand its network, launch supply operations in the US, Ireland and Spain, develop 1 TW of solar, wind and storage projects worldwide, introduce its plug-and-play solar-battery kit, and start delivering its intelligent home energy operating system. Fuse Energy combines renewable power project execution, power generation, trading, supply, installations and hardware. The company was set up in 2022 by former Revolut executives, Alan Chang and Charles Orr. (source: Renewables Now)

Valinor, a Washington DC-based operational holding company for defense and government technology, raised $54 million in Series A funding. The round brings the company's total capital to over $85 million since its founding in 2024. Friends & Family Capital led the investment. The venture capital firm, co-founded by former Palantir CFO Colin Anderson and veteran investor John Fogelsong, brings deep finance experience and capital allocation expertise to support Valinor's expansion in the defense market. Existing investors General Catalyst, Founders Fund, and Red Cell Partners continued their backing, while new participants Narya, XYZ Venture Capital, and Fifth Down Capital joined the round. (source: 180 Tech News)

Bobyard announced it has raised a $35 million Series A led by 8VC, with participation from Pear VC, Primary Venture Partners, Tishman Speyer, RXR ARDEN Digital Ventures (RADV), and Caffeinated Capital. Bobyard is transforming how contractors perform construction takeoffs and estimates through AI. This funding will allow us to continue advancing our AI models and product capabilities in landscaping while expanding into additional trades, including drywall, electrical, HVAC, plumbing, and framing. (source: LinkedIn)

Vital Lyfe raised a $24 million seed round (led by Interlagos and General Catalyst) to develop portable, autonomous water-making systems that turn any natural source into purified water anywhere on Earth. The company was founded by former SpaceX engineers Jon Criss (CEO) and Andrew Harner (COO) who are applying aerospace-grade engineering to water production. Other investors include Generational Partners, Cantos, Space VC, and Also Capital. The technology operates independently of grids and infrastructure, targeting marine environments where desalination is most challenging. The funding will accelerate manufacturing and field deployments toward the first consumer-ready products launching in 2026. (source: Axios)

Array Labs announced a $20 million Series A financing led by Catapult Ventures, with participation from Washington Harbour Partners, Kompas VC, and other new and existing investors, including Y Combinator, Maiora Ventures, SuperOrganism, Gaingels, Hexagon, Animal Capital, Aera VC, Cultivation Capital, and Clearance Ventures. The round brings Array’s total funding to $35 million since going through Y Combinator. The company previously raised a $5 million seed in 2022 after completing YC, followed by a $10 million round in 2024. In 2025, Array Labs doubled the size of its team, completed the design of its satellite bus, formed two new product lines, and grew commercial bookings to nine digits in contracted revenue. The company has also been selected for roughly half a dozen government awards over the last 24 months, across the U.S. armed services, intelligence community, and key combatant commands. (source: Array Labs)

MATERIAL has raised a $7.1 million seed round, co-led by Outlander VC and Harpoon, with participation from GoAhead Ventures, Myelin VC, Demos Capital, and Giant Step Capital, and is executing a $1.25M Phase II SBIR contract with the U.S. Air Force. For decades, energy storage has forced products to be designed around the battery. MATERIAL is building a whole new paradigm by making energy adaptable to the product itself. (source: LinkedIn)

R2 Wireless announced the successful closing of an oversubscribed $5.3 million financing round. We thank the new investors who support and believe in our mission, including Origin Ventures, Spring Rock Capital, Corner Ventures, and Exitfund, as well as existing investors who doubled down on their previous investment, including Texas Venture Partners, 1948 Ventures, and our strategic angel investors. This latest equity financing follows strong momentum for ODIN, its RF targeting and spectrum dominance platform, and will fuel global expansion with Tier-1 defense and homeland security customers in the U.S. and Europe. (source: LinkedIn)

Super Powers Mobility (SPM) announced the close of its $1.3 million pre-seed round to accelerate the commercialization of its dual-use electric off-road powertrain technologies. Boost VC led the round. Other participants included Harpoon, Quorum Capital Partners, Goken America, Innovation Works, and 9 angel investors. (source: LinkedIn)

AE Ventures has led a strategic investment in Blank Slate Technologies, with continued participation from Fulcrum Venture Group. “Blank Slate is solving pressing readiness challenges that face our most critical aerospace and defense operators today and doing so in a way that is already proving its value in the field,” said Tyler Rowe, Partner at AE Ventures. “We see a significant opportunity for the Blank Slate team to scale into every corner of heavily regulated, high-stakes industries where human performance truly matters.” The investment will support continued expansion across defense, aviation, and national security, while accelerating product development and the scaling of Blank Slate’s enterprise and government platforms. (source: Blank Slate)

One Bow River announced its investment in LEAP. Using proprietary propulsion and modernized vehicle manufacturing, LEAP delivers dedicated, on-demand transport for national security and commercial payloads, as well as point-to-point space logistics that enable global delivery in under 45 minutes. From LEAP, “This investment is a strong validation of LEAP’s mission and technology, and its direct alignment with commercial and national security priorities. It accelerates our shift from development into scaled execution, expanding manufacturing capacity, advancing flight operations, and continuing vehicle development." (source: LinkedIn)

Join over 2,800 of the best & brightest in the hard tech community and subscribe to the only commercial real estate hard tech newsletter, Space Dirt!

AGREEMENTS, PARTNERSHIPS, & CONTRACTS

NVIDIA is making its largest purchase ever, acquiring assets from 9-year-old chip startup Groq for about $20 billion. The company was founded by creators of Google’s tensor processing unit, or TPU, which competes with NVIDIA for artificial intelligence workloads. Groq, which was valued at $6.9 billion in a September financing round, framed the deal as a “non-exclusive licensing agreement,” with its CEO and other senior leaders joining NVIDIA. (source: CNBC)

Arlington Capital Partners, a Washington, D.C.-area private investment firm specializing in government-regulated industries, announced it has agreed to sell Stellant, a premier designer and manufacturer of radio frequency (“RF”) and microwave amplification products, to TransDigm Group, a leading global designer, producer and supplier of highly engineered aircraft components, for $960 million. Headquartered in Torrance, CA, Stellant designs and manufactures vacuum electron devices, solid state power amplifiers, and related RF components for the defense, space, medical, and industrial markets. The Company supports critical space, radar, missile and secure communications platforms for the Department of War and allied militaries globally. Stellant operates across four U.S. facilities, totaling more than 700,000 SF of advanced manufacturing space and employs approximately 950 people. The transaction is expected to close in 2026, subject to customary regulatory approvals and closing conditions. (source: Arlington Capital Partners)

Rocket Lab has been awarded its largest contract to date: an $816 million prime contract from the U.S. Space Development Agency to design and manufacture 18 missile-tracking satellites for the Tracking Layer Tranche 3 program. The satellites will provide continuous global detection, including for hypersonic threats, using Rocket Lab’s next-generation Phoenix infrared sensors and StarLite protection technology. Built on the Lightning platform, the program leverages Rocket Lab’s fully in-house production model to deliver speed, resilience, and cost efficiency. With more than $1.3 billion in SDA contracts awarded, Rocket Lab continues to demonstrate its ability to deliver large-scale, mission-critical space infrastructure. (source: Globe Newswire)

Onebrief’s Series D funding has enabled them to acquire Battle Road Digital, a leading defense innovation company applying best-in-class gaming technology to defense and national security challenges. Effective immediately, Battle Road Digital’s capabilities in real-time operational decision support become part of Onebrief’s expanding ecosystem, transforming the platform into an Operating System that enables military leaders to see, simulate, and decide faster than ever before. (source: Onebrief)

Magnet Defense acquired Metal Shark to accelerate autonomous maritime capabilities and U.S. shipbuilding capacity. Miami-based Magnet Defense (developer of fully autonomous maritime platforms for fleet operations and missile defense) acquired the Louisiana-based shipbuilder to gain production muscle for the U.S. Navy's Golden Fleet initiative. Metal Shark operates two manufacturing facilities in Louisiana totaling 125,000+ SF across 40 acres and brings 20+ years of experience with over 2,000 vessels delivered worldwide (500+ to U.S. Navy, 600+ to U.S. Coast Guard). The acquisition moves Magnet Defense from prototype development to sustained delivery of AI-enabled unmanned surface vessels at scale. (source: Marine Log and PR Newswire)

Cambium acquires SHD Group to accelerate its materials innovation and production platform. El Segundo-based Cambium (advanced materials developer) acquired Sleaford, UK-based SHD Group (global advanced composites manufacturer) to create a global advanced-materials leader combining AI-driven innovation with scalable manufacturing. SHD operates four sites: UK headquarters, two in the U.S. (North Carolina and Oklahoma), and one in the EU (Slovenia). The combined company delivers orders 10x faster than competitors with a 48-hour turnaround capability. SHD founders Steve and Helen Doughty continue as director of innovation and director of integration, respectively. Brett Schneider becomes president of SHD and Cambium Composites. Financial terms not disclosed. (source: PR Newswire)

L3Harris sells majority stake in Space Propulsion and Power Systems business to AE Industrial Partners for $845 million (expected to close in the second half of 2026). AE Industrial will acquire 60% interest while L3Harris retains 40% ownership. The business includes RL-10 upper-stage engines for commercial and government launches, in-space electric thrusters, and space power systems. The RS-25 rocket engine program (for NASA's Space Launch System) is excluded and remains fully owned by L3Harris. AE Industrial plans to restore the "Rocketdyne" name for the acquired business. The deal reflects L3Harris' strategic refocus on core defense priorities, such as missile production. AE Industrial has previous space investments in Firefly Aerospace, Redwire Space, and York Space Systems. (source: SpaceNews)

Turion Space, a space infrastructure company that builds and operates mission-grade spacecraft and space operations software, today announced it has completed the acquisition of Tychee Research, a Los Angeles-based company specializing in high-speed, high-fidelity astrodynamics and advanced mission engineering. Tychee and TMPL continue to support multiple clients and advanced, operational programs. TMPL will support current users and mission needs, with expanded integration and product evolution underway as part of Turion’s Starfire portfolio. Financial terms of the transaction were not disclosed. (source: SpaceNews)

Niron Magnetics partnered with Moog Inc. to develop rare-earth-free actuators for guided munitions systems using Iron Nitride magnet technology. Minneapolis-based Niron Magnetics (the world's only producer of high-performance rare-earth-free permanent magnets) is collaborating with New York-based Moog (NYSE: MOG.A and MOG.B, precision motion and fluid controls manufacturer) to reduce reliance on Chinese-controlled rare-earth supply chains. The partnership addresses Pentagon concerns over China's dominance in rare earth magnet production (particularly neodymium-iron-boron magnets used in F-35s, nuclear subs, missiles, and drones). Niron's Iron Nitride technology performs comparably to rare earth magnets at high temperatures and is domestically produced in Minnesota with plans for a full-scale production facility in Sartell by mid-2027. The collaboration aligns with DoD's Acquisition Transformation Strategy focused on supply chain diversification and domestic production. (source: Tectonic Defense)

The U.S. Department of Energy (DOE) announced $2.7 billion to strengthen domestic enrichment services over the next ten years. The following companies were awarded task orders totaling $2.7 billion to provide enrichment services for low-enriched uranium (LEU) and high-assay low-enriched uranium (HALEU):

American Centrifuge Operating ($900 million) to create domestic HALEU enrichment capacity

General Matter ($900 million) to create domestic HALEU enrichment capacity

Orano Federal Services ($900 million) to expand U.S. domestic LEU enrichment capacity (source: X)

CX2 and Picogrid announced a new collaboration. Legacy workflows in forward-deployed environments often require a tradeoff between situational awareness and increased electromagnetic signature, raising the risk of asset detection when countering airborne threats. Picogrid partnered with CX2 to integrate RF sensor data into Picogrid Legion, enabling a layered tip-and-cue workflow for radar tasking at Fort Bragg. This approach enabled the detection and tracking of aerial threats, from Group 1 UAS to Apache helicopters, while minimizing active emissions in the field. (source: LinkedIn)

WHAT I’M CONSUMING (AND ENJOYING!)

📜 I like the simple way the above chart breaks down the current set of major hard tech players in their respective domains. Found this in a LinkedIn post by Balerion Space Ventures General Partner Daniel Kleinmann.

📈An encouraging article from the Los Angeles Business Journal on Los Angeles’ hard tech ecosystem. This section was my favorite: Of all the funding from venture capitalists in Los Angeles this year, 38% went toward military and aerospace companies – more than any other industry in the region, according to PitchBook. Half of the companies inducted into the unicorn club this year belong to the space and national security sector. Today, all aerospace and military unicorns are valued at a combined $416 billion – making up around 78% of all unicorn value in Los Angeles.

🦄 Former SpaceX employees have launched startups with over $3 billion in venture funding. This Business Insider article illuminates the SpaceX mafia by listing 18 startups helmed by SpaceX-employees-turned-founders, in alphabetical order by company name.

🚫 In Nathan Mintz’s latest Substack, he unpacks how the FCC's blocking of new foreign-made drones and related components from entering the U.S. affects us and the U.S. drone ecosystem.

🖨 Some thoughts on additive manufacturing from John Borrego, SVP of aerospace and defense at Machina Labs. (h/t to Nathan Mintz for the referral)

HOW I CAN HELP YOU

Here are 3* ways I can help when the time is right:

Find a new home for your growing business. You're scaling fast, and you don't have time to become a CRE expert. I do this every day.

Sublease your space. Outgrown your office, but don't want to pay two rents? I'll help you find a subtenant.

Negotiate your lease renewal. Want to make sure you’re getting a fair deal from your Landlord? In my experience, you can never be too sure. Start 12 months out, so you're not scrambling at the last minute.

Strong references available. Let's talk.

*Not an exhaustive list 💪

Thanks for reading.

If you’d like your office and/or manufacturing space or business profiled - or even your city! - let me know. It’s always fun to explore and share the different components of the hard tech industry.

Erik Stiebel

Founder and Vice President

CA DRE License #02080746

424.241.4795 | [email protected]

Follow me on 𝕏

Reply