- Space Dirt

- Posts

- July's Space Dirt 🚀 (mid-month)

July's Space Dirt 🚀 (mid-month)

Where commercial real estate meets hard tech

Greetings! In this issue:

7 companies emerging from stealth

A location incentives primer from yours truly

9 fundings (plus some interesting funding insights courtesy of Pitchbook)

10 pieces of content I think you might enjoy…

And a whole lot more.

Enjoy!

REAL ESTATE HIGHLIGHTS

Upgrade Energy’s new spot in El Segundo, CA. (image: Costar)

Upgrade Energy leased 4,700 SF at 145 Sheldon St, El Segundo, CA. (source: Me!)

Vital Lyfe leased 4,320 SF at 12700 Yukon Ave. Hawthorne, CA. (source: Me!)

Volund Manufacturing leased 5,337 SF at 15171 Pipeline Ave, Huntington Beach, CA. (source: Me!)

Moog’s new electromechanical actuation facility in East Aurora, NY. (image: Moog)

Moog has completed its new electromechanical actuation facility in East Aurora, NY, enhancing its manufacturing capabilities for space and defense customers that require precision steering in the most demanding domains. The 120,000 SF facility is the largest Moog site dedicated to its diverse space portfolio, which includes components and systems for launchers, missiles, satellites, and human habitats. (source: SpaceNews)

Podium Automation leased 10,000 SF at 300 Meserole St, Brooklyn, NY. (source: LinkedIn)

Northwood Space is building things in South Africa (source: X)

Torrance, CA’s Northwood Space breaks ground in… South Africa. (source: X)

STEALTH NO MORE

Yaron Alfi, Dave Wilson, and Davide Semenzin founded Magenta in El Segundo, CA. “Magenta enables hardware engineers to tackle tedious and complex tasks with the support of specialized AI Agents. Design, documentation, and compliance tasks that used to take me days now takes minutes. It was important to us to build a tool that compliments your existing software (from spreadsheets to Netsuite), and requires little effort to get started.” (source: LinkedIn)

Emerging from stealth mode, Tiberius Aerospace was founded in 2022, in response to a new era of conflict where speed, adaptability, cost-effective capability, and supply chain assurance are essential to national security. Tiberius rapidly delivers high-impact, compliant, modular, and open-architecture weapon systems. Tiberius also announced its flagship weapons program, Sceptre (TRBM 155HG), a revolutionary new liquid-fuelled, 155mm Ramjet extended-range precision-guided artillery munition. Sceptre delivers superior precision and dramatically improves the cost-effectiveness of all howitzer-class artillery. Chad Steelberg is the Founder and CEO of Tiberius Aerospace. Tiberius is headquartered in Newport Beach, CA. (source: Tiberius)

Apolink, a Y Combinator-backed space-tech startup founded by a 19-year-old Indian-origin entrepreneur, Onkar Singh Batra, has raised $4.3 million in an “oversubscribed” seed round at a $45 million post-money valuation to build a real-time connectivity network for satellites in low Earth orbit (LEO). Its new seed round was backed by Y Combinator, 468 Capital, Unshackled Ventures, Rebel Fund, Maiora Ventures, and several angel investors, including Laura Crabtree (CEO of Epsilon3), Benjamin Bryant (co-founder of Pebble Tech), and Kanav Kariya (president of Jump Crypto). The startup is tackling a persistent problem in space communications. Satellites frequently go offline during parts of their orbit due to dead zones — periods when they are not in the line of sight of a ground station. (source: TechCrunch)

Perseus Defense (YC S25) is building America’s Iron Dome for drones. Their micro-guided missiles detect, identify, and eliminate incoming threats before they reach their target, for under $10,000 each, 2 orders of magnitude cheaper than today’s best solutions. Can be standalone or mounted on vehicles and unmanned assets. The founders, Jason Cornelius, PhD (ex-NASA) and Steve Messinger (ex-Boeing), are aerospace engineers who’ve designed the Titan Dragonfly space helicopter, enabled commercial airliners to land autonomously, created an international drone competition, and advanced swarm behaviors for unmanned vehicles. (source: X and LinkedIn)

Co-founder Sean Simmons, recently announced that Robot Toolworx has emerged from stealth with a LinkedIn post. Daniel Crain is the CEO. Zahid Hussain is the other Co-founder. From LinkedIn: Robot Toolworx is building a software platform for modernizing assembly, maintenance, and repair processes in industries such as aviation, defense, maritime, automotive, heavy equipment, and aerospace. Our category-defining solution is powered by advanced AI and 3D modeling technologies.

Austin, TX-based Valstad closed a $2.6 million pre-seed round led by N49P, with participation from 10VC, Elementum, and Northside Ventures. “The proceeds will be used to grow our team & complete design work for our inaugural shipyard - scheduled to start cutting steel in the second half of 2026 - and first products. Our goal: 100x America's shipbuilding output, from 5 or fewer large ships per year to 500.” (source: Valstad)

On LinkedIn, Holley Rockwell announced Unmatched Ventures, a talent-led investment firm, combining executive search, advisory, and capital to back the frontier of U.S. reindustrialization. They invest in and build leadership teams for companies driving critical innovation in hard tech. (source: LinkedIn)

Join over 1,800 of the best & brightest in the hard tech community and subscribe to the only commercial real estate hard tech newsletter, Space Dirt!

REAL ESTATE CORNER: LOCATION INCENTIVES

Recently, I’ve had several clients come to me with questions about location incentives. So, I figured I’d share an abridged version of my location incentives deck.

If you’d like the whole deck, DM me. Happy to share.

And now, back to the show…

Location incentives have become a major factor in corporate relocation decisions, particularly for hard tech companies with a heavy manufacturing component.

While these programs offer significant potential savings, they're not suitable for every business.

This primer will help you understand what location incentives are, whether your company might qualify, and what the process entails.

But first…

What Are Location Incentives?

Location incentives are financial benefits offered by state and local governments to encourage businesses to relocate or expand in their area.

These incentives are a key tool in economic development strategies, designed to attract new businesses and jobs while helping companies reduce their cost of doing business.

Popular incentives include: infrastructure grants, discretionary grants, state income tax offsets, property tax abatements, and utility cost offsets, but there are plenty more.

Incentive packages are typically structured over 20 years or more and can generate savings of 5-20% of a company's capital budget.

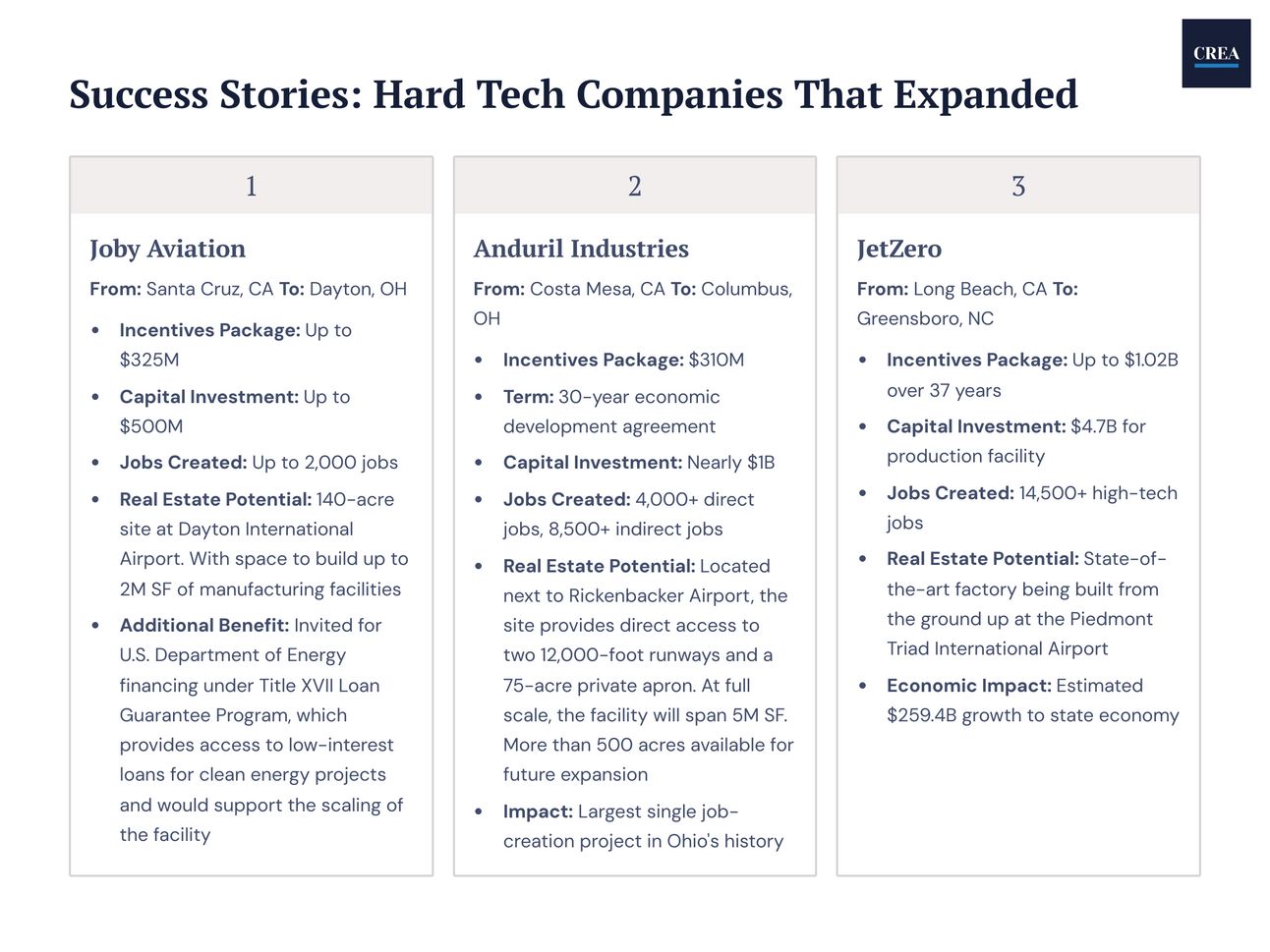

To see incentive packages in action, I’ve gathered three examples:

(source: CREA Research)

You may have noticed that those are some big names with sizable capital investments and significant job creation (you’re going to need to create at least 100 jobs to even get your application looked at). These factors, along with your tech and business model, will also be taken into consideration.

But perhaps the most looming factor is your timeline — will you be able to meet job creation and investment commitments within specified timeframes?

Because if you can’t, there are plenty of clawback provisions that basically allow for the state and/or local government to remove the incentives. That would not be fun.

While incentives grab headlines, successful manufacturing relocations involve multiple factors, with each state and even each local government bringing different things to the table. And that’s not even taking into account finding and negotiating the right site. In short, there’s a lot to sort through.

I’m happy to review your options with you if and when you consider expanding.

-Erik

NOTABLE FUNDINGS

Not a funding, but worth mentioning: NATO nations agreed to spend at least 5% of their GDP on defense by 2035, marking a major diplomatic win for the Trump administration. The NATO pledge includes 3.5% on core defense and 1.5% on securing critical infrastructure. This is a strong tailwind for defense-tech startups, which, over the past few years, have moved from venture capital's Island of Misfit Toys to Love Island. (source: Axios)

Hypersonic weapons startup Castelion is raising a $350 million Series B round, led by Lightspeed Venture Partners and Altimeter Capital, according to sources and documents reviewed by TechCrunch. (source: Founders Today)

Varda Space Industries has secured $187 million in Series C funding to further develop its space-based drug manufacturing capabilities. The round was led by Natural Capital and Shrug Capital, with participation from Peter Thiel, Lux Capital, Khosla Ventures, and Caffeinated Capital, and will allow the company to increase the frequency of its orbital missions and expand its ability to process pharmaceutical ingredients in orbit. Varda aims to leverage microgravity to create novel drug formulations that are difficult or impossible to produce on Earth. (source: The Wall Street Journal)

Firefly Aerospace filed for an IPO with $176.9 million in cash and cash equivalents. The net proceeds from the IPO will be used in part to repay that outstanding loan, according to the S-1. The company also cited strong customer demand, noting that as of March 31, it had about $1.1 billion worth of backlogged launch orders and spacecraft contracts. That’s about double from the $560 million in backlogged orders it had from a year prior. Lead underwriters on the deal include Goldman Sachs, JPMorgan, Jefferies, and Wells Fargo. (source: CNBC)

Xona Space Systems announced a total of $92 million in new unannounced funding. This includes its Series B round led by Craft Ventures, with participation from existing investors including Stellar Ventures, Seraphim Ventures, Toyota Ventures, First Spark, Industrious Ventures, Future Ventures, and NGP Capital. Sky Dayton of Craft Ventures will join Xona’s board. Its new funding also includes $20 million in non-dilutive funding through its Strategic Funding Increase (STRATFI) award from SpaceWERX, the innovation arm of the United States Space Force. This brings Xona’s total funding to date to over $150 million. (source: Xona)

Emerald AI, a startup tackling data center power demands, emerged from stealth with $24.5 million in seed funding. Their software manages energy consumption, prioritizing critical tasks to reduce grid strain. A Phoenix pilot with Oracle and Salt River Project cut AI power demand by 25% during peak times. The round was led by Radical Ventures and backed by NVIDIA and other prominent investors. (source: Hardware FYI - LinkedIn)

Civ Robotics, a construction robotics startup, raised $7.5 million in Series A funding to advance its autonomous surveying technology. Their flagship product, CivDots, uses unmanned ground vehicles to mark thousands of coordinates daily for infrastructure projects like solar farms and roadways. The funding will drive global expansion and further development of the core robotics platform. The round was led by AlleyCorp. (source: Solar Builder)

Clippership raised $4.6 million to advance autonomous maritime freight. Fifty Years led the round, and Founders Factory participated. According to Clippership, the capital will be used to: 1. Build our next generation prototype, a 10-ton offshore-capable vessel that will be used to test our autonomy and wing-sail technology in open-ocean conditions. 2. Design AND build our 23.9-meter autonomous cargo vessel, capable of transporting 80 pallets between Europe and the U.S. (source: LinkedIn)

CisLunar Industries announced $1 million in seed funding from the Colorado ONE Fund. The investment will help CisLunar hire more engineers and scale the production of its power processing units (PPUs). While the seed round isn’t closed, the early investment marks a step forward for CisLunar’s plans to transform from a small batch producer of PPUs for research and grant projects to a large-scale manufacturer for commercial and defense customers. Its goal is to increase production capacity to tens of PPUs per month starting next year. (source: Payload)

Sceye, a U.S. aerospace company specializing in High-Altitude Platform Systems (HAPS) for connectivity and environmental monitoring from the stratosphere, announced it received a strategic investment from SoftBank, a leading operator of telecommunications and IT businesses in Japan and globally. The investment was made as part of the first tranche of Sceye's Series C funding round. In addition to the strategic investment, SoftBank is also purchasing a HAPS pre-commercial Japan flight in 2026. (source: PR Newswire)

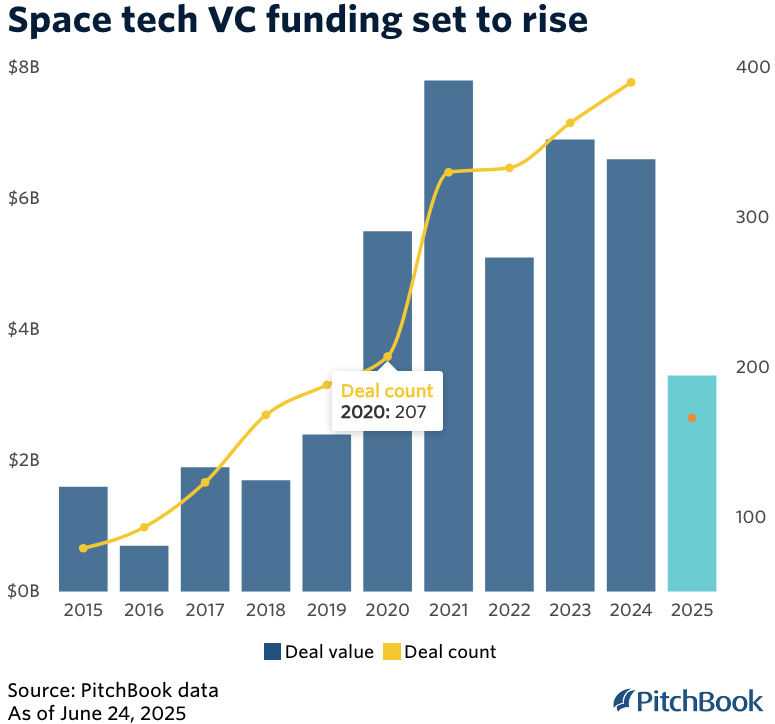

According to PitchBook data, VC investment in space tech has reached $3.3 billion this year, which puts 2025 on course to reverse last year’s funding dip. However, the deal count could land below last year’s level, with most capital going toward mature startups.

Late-stage deals accounted for 41.3% of space tech VC deals this year, up from 39% in 2024, the highest percentage in a decade. This suggests the overall market is transitioning away from its more speculative phase and that investors are putting more capital into well-established businesses. Demand for space tech startups is being fueled by a surge in investor appetite in defense-related verticals. I’d recommend reading the whole article. (source: Pitchbook)

AGREEMENTS, PARTNERSHIPS, & CONTRACTS

“Blackbeard” hypersonic missiles made by Castelion. (image: Castelion)

In its FY26 budget, the U.S. Army is requesting $25 million to develop “Blackbeard” hypersonic missiles made by Castelion. Castelion’s Blackbeard is looking to fit into the “low” end of the “high-low mix” (the $41M/unit Dark Eagle LRHW would be “high”). The missile would offer the Army a cheaper, quicker-to-build alternative that can travel shorter distances. (source: Tectonic)

Frontier, the organization backed by Stripe, Google, and Meta, announced Tuesday it is paying startup Arbor Energy to remove 116,000 tons of carbon dioxide by the end of the decade. Frontier has facilitated offtakes with Arbor, a Bioenergy with Carbon Capture and Storage (BECCS) company that uses waste biomass to create clean energy while removing CO₂. Frontier buyers will pay Arbor $41 million to remove 116,000 tons of CO₂ between 2028 and 2030. BECCS is a promising carbon removal pathway because it could remove multiple gigatons of CO₂ per year by 2050, while also producing low-carbon heat and electricity. These offtakes will enable the launch of Arbor’s first commercial facility and test the viability of a new, highly efficient BECCS approach for generating clean electricity and removing CO₂. (source: TechCrunch)

Rendering of Rocket Lab’s ocean landing platform for its Neutron reusable rocket. (image: Rocket Lab)

Rocket Lab announced it has awarded a contract to Bollinger Shipyards, the largest privately owned new construction and repair shipbuilder in the United States, to support the build-out of Rocket Lab’s ocean landing platform for its Neutron reusable rocket. Modification and fit-out of Rocket Lab technology to its 400-ft-long landing platform named ‘Return On Investment’ has begun and is taking place at Bollinger Shipyards, primarily at its shipyard in Amelia, Louisiana, with delivery of the vessel to Rocket Lab expected in early 2026. (source: Rocket Lab)

Not a contract, but should have a significant downstream effect… The U.S. Army is requesting $192 billion for its fiscal 2026 base budget and is also banking on an additional $5.4 billion in funding included in a separate $113 billion party-line spending bill now under debate in Congress, according to a service-issued budget overview document. Factoring both the base request and the one-time bill, the Army is planning on working with a budget of $197.4 billion, which marks a nearly 7% increase over last year’s enacted amount of $184.6 billion. The Army announced at the start of last month that it would undertake a massive transformation to include consolidating major commands, making drastic force structure changes and canceling a wide variety of programs where billions have already been spent to make way for priority efforts perceived to increase overall lethality. (source: Defense News)

WHAT I’M CONSUMING (AND ENJOYING!)

👨🔧 MaC Venture Capital gives one of the most comprehensive breakdowns on hard tech in the economy I’ve seen. If I were a student having to write a paper on hard tech’s evolving impact in the world, I’d be psyched. “This is the new frontier. Not hardware in isolation, but hardware fused with deep science, software, and intelligent systems. These companies don’t just disrupt markets. They create them.”

🇺🇸 Here’s the third annual NatSec100. Silicon Valley Defense Group, in partnership with J.P. Morgan created a report that identifies the top 100 venture-backed, dual-use and defense technology companies driving forward U.S. national security.

💧 Cantos Partner Grant Gregory, explains why he feels good about investing in Vital Lyfe.

⛓ Base Power’s Co-founder and COO, Justin Lopas, looks back and gives some tips on setting up and managing your supply chain.

🎙 Phillip Gulley, co-founder of Cofactr, was on the Real Finds podcast, where he shares how he stumbled into the world of trade and logistics by building hardware, only to discover that real success required managing compliance, tariffs, duty drawback, and end-to-end traceability.

✎ Zach Glabman spent 14 days visiting 28 factories across America—from machine shops in Detroit to aerospace suppliers in Los Angeles and wrote (a good) article about it, The Case for American Manufacturing.

🕹 An international volunteer on a first-person view attack drone team in the Armed Forces of Ukraine gives his take on first-person view drones after using them for 6 months in real-world combat (he doesn’t love them).

🎯 Forbes gives us a peek behind Union’s origin story and its CEO, Will Somerindyke.

📝 Secretary of Defense Pete Hegseth released a memo, “Unleashing U.S. Military Drone Dominance,” that seeks to rescind “restrictive policies that hindered production and limited access to these vital technologies.” (source: Tectonic)

🛒 Pipedream is building a 40-mile underground pipe network in Austin to deliver physical goods via 100mph-traveling autonomous robots. The company is announcing its first-ever Rapid Fulfillment Center (RFC) in Austin, Texas. They have a bunch more announcements you can check out here: X.

HOW I CAN HELP YOU

Some people only know me as “that Space Dirt newsletter guy.” Although I love that moniker, here are 3* ways I can help with your hard tech real estate when the time is right.

A new home for your growing business. The good news - you’re growing! The bad news - you need to move, and you don’t know the hard tech real estate market. I can help. And I come with strong references.

Sublease your space. You’ve outgrown your space and need to move but don’t want to pay two rents? I got you.

Time to renew your lease? Want to make sure you’re getting a fair deal from your Landlord? In my experience, you can never be too certain. (BTW, I recommend starting the lease renewal process 12 months out at a minimum.)

*Not an exhaustive list 💪

Thanks for reading.

If you’d like your office and/or manufacturing space or business profiled - or even your city! - let me know. It’s always fun to explore and share the different components of the hard tech industry.

Erik Stiebel

Founder and Vice President

CA DRE License #02080746

424.241.4795 | [email protected]

Follow me on 𝕏

Reply