- Space Dirt

- Posts

- November's Space Dirt 🚀 (month-end)

November's Space Dirt 🚀 (month-end)

Where commercial real estate meets hard tech

Vulcan Elements is investing $1 billion to build a rare earth magnet facility in Benson, NC, that will create 1,000 jobs and produce 10,000 metric tonnes of magnets annually. CX2 is expanding in El Segundo. These are two of four real estate stories, four stealth companies, 10 fundings, and 18 partnerships in this issue of Space Dirt.

Plus, two pieces of engaging content, a sublease opportunity in El Segundo, and details on our December 11th Space Dirt holiday mixer.

Enjoy!

REAL ESTATE HIGHLIGHTS

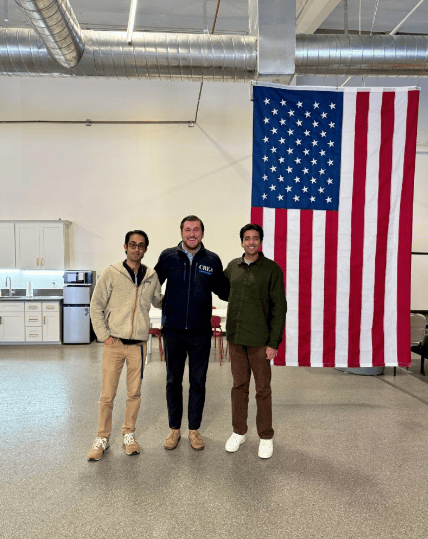

CX2’s new HQ in El Segundo. (image: Costar)

Vulcan Elements has selected Benson, NC, as the location for its $1 billion rare earth magnet manufacturing facility. At its location in Benson, Vulcan Elements will expand to 10,000 metric tonnes of rare earth magnet manufacturing capacity and create 1,000 new American jobs—executing on the company’s $1.4 billion partnership with the United States Government. The facility will be a critical asset for the United States as it onshores the rare earth magnet industry and secures an essential supply chain for American economic dynamism and national security. (source: X)

Castelion announced Project Ranger, a 1,000-acre solid rocket motor manufacturing campus in Sandoval County, NM, dedicated to next-generation hypersonic systems. The initiative is projected to create 300 high-quality jobs and generate over $650 million in economic output over the next decade. Castelion plans to invest more than $100 million in Project Ranger's development, with additional capital to follow. The facility will produce solid rocket motors, conduct static tests, and assemble components to produce finished rounds. Castelion is headquartered in Torrance, CA, with additional facilities in Texas. (source: Castelion)

STEALTH NO MORE

Four companies emerged from stealth in since the last Space Dirt, each solving a different piece of the hard tech puzzle:

Twenty emerged from stealth as America's first and only venture-backed cyber warfare startup. The company delivers industrial-scale cyber capabilities to enable the United States and its allies to deter and defeat adversaries. Twenty's software executes cyber operations at an industrial scale and machine speed using intelligent and autonomous capabilities. In its first year, the company secured customers across the U.S. military and Intelligence Community and assembled a team of veterans from U.S. Cyber Command, National Security Agency, the IC, and the team behind the most successful SaaS cyber product in U.S. military history. Twenty raised $38 million from top defense tech investors, including Caffeinated Capital, General Catalyst, Friends & Family Capital, IQT (In-Q-Tel), and Tim Junio and Matt Kraning (Expanse Co-founders, acquired by Palo Alto Networks). The Co-founder and CEO is Joseph Lin. (source: LinkedIn and Ventureburn)

Why this matters: Cyberspace is the front line of the existential competition with China and Russia, but the U.S. still operates with manual, human-speed cyber capabilities. If Twenty can deliver AI-powered offensive cyber operations that scale to industrial levels, they're building the equivalent of what Palantir did for intelligence analysis—turning America's cyber operators into force multipliers who can operate at machine speed instead of human speed.

Maritime Fusion emerged from stealth with a $4.5 million seed round to build a new class of low-power-density fusion reactors designed specifically for ships and off-grid systems. The round was led by Trucks VC with participation from Aera VC, Alumni Ventures, Paul Graham, Y Combinator, and several angel investors. The company was part of Y Combinator’s winter 2025 batch. Unlike most fusion companies that target grid-scale power (which requires extremely high power density and near-continuous uptime), Maritime Fusion is starting with use cases that need far less power, have lower uptime requirements, and can hit cost parity sooner—reducing the toughest materials and confinement challenges. The team of former Tesla engineers is developing Yinsen, a compact HTS (high-temperature superconducting) tokamak, with research support from Columbia University and the U.S. Department of Energy's DIII-D facility. They're also building SHIELD, a high-temperature superconducting cable that recently carried 5,000 amps at 77K in a liquid-nitrogen test. The cable is small enough to fit inside a quarter yet powerful enough for fusion magnets, and the same technology can be sold into data centers for denser, more efficient power transmission. Justin Cohen and Jason Kaufmann are Co-founders. (source: LinkedIn and TechCrunch)

Why this matters: Every fusion company is racing to solve the hardest problem first (grid-scale power), which means they all hit the same material science and physics walls at the same time. Maritime Fusion is betting that starting with lower-stakes applications (ships, off-grid systems) lets them commercialize fusion years earlier—and the cable technology gives them a revenue stream today while they build toward fusion tomorrow. If they're right, the first commercial fusion reactor won't power a city. It'll power a ship.

Null Labs (YC F25) emerged from stealth, building infrastructure for defense autonomy that generates physics-accurate synthetic data on demand. The company is addressing a critical problem in military AI: models break when they encounter new camouflage patterns, different sea states, or target variants. Ukrainian operators described how Russian forces used cheap camouflage nets to reliably confuse computer vision models, forcing Ukrainian teams to spend weeks collecting and labeling new datasets repeatedly. Null Labs' infrastructure allows teams to generate the exact data they need when they need it, enabling AI systems that understand how the physical world works. Since launching a few months ago, the company joined Y Combinator, closed its first paying defense customer, and demonstrated the ability to generate over 10,000 physics-accurate synthetic frames in minutes. Co-founders are Kristopher Luo and Niel Ok. (source: LinkedIn)

Why this matters: The dirty secret of defense AI is that every model is brittle. Change one variable in the real world (lighting, weather, camouflage) and the system fails. Fixing it requires weeks of manual data collection, which means adversaries can deliberately break autonomous systems with cheap tactics. If Null Labs can generate physics-accurate synthetic training data in minutes instead of weeks, they're solving the generalization problem that's holding back every autonomous weapon system in development.

Extellis emerged from stealth with an oversubscribed $6.8 million seed round led by Raleigh-based Oval Park Capital to build high-volume, all-weather satellite imaging that delivers reliable Earth observation data at an industrial scale. The Durham, NC-based startup spun out of Duke University with patented metasurface antenna technology that enables an unprecedented blend of wide-area scanning and reliable, high-resolution sensing. The technology builds on a decade of development in co-founder and Prof. David Smith's lab at Duke University and was advanced through a $2.3 million DARPA grant. Unlike optical systems (which can't see at night or through clouds) and traditional synthetic aperture radar (SAR) systems (which only operate 2% of the time before overheating), Extellis' satellites can take thousands of SAR images per day. Michael Boyarsky is the Co-founder and CEO (PhD in electrical and computer engineering from Duke, former research scientist at the university). Other investors include Duke Capital Partners, First Star Ventures, New Industry VC, Front Porch Venture Partners, EGB Capital, and Blue Lake VC. The seed round will fund Extellis' first orbital demonstration satellite. (source: Hypepotamus and EINPresswire)

Why this matters: Satellite imaging is stuck between two bad options: optical satellites that can't see through clouds or at night, and SAR satellites that are so expensive only defense customers can afford them. If Extellis can deliver all-weather SAR imaging at commercial prices (by running 50x more uptime than existing systems), they're unlocking massive markets that can't use satellites today: precision agriculture, pipeline monitoring, shipping logistics, and vegetation management. The difference between imaging 2% of Earth and imaging all of it, constantly, is the difference between a defense niche and a global utility.

Join over 2,500 of the best & brightest in the hard tech community and subscribe to the only commercial real estate hard tech newsletter, Space Dirt!

REAL ESTATE CORNER

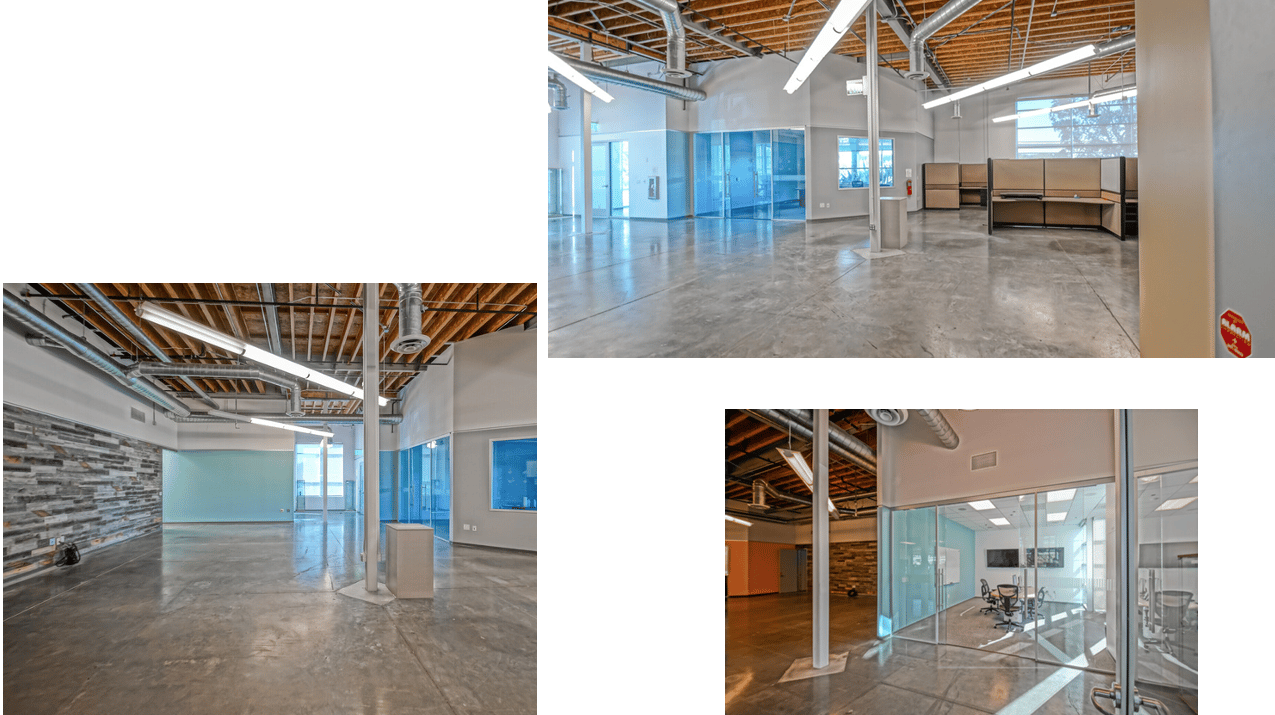

SUBLEASE OPPORTUNITY IN EL SEGUNDO

If you’re in the market for a flex sublease, check out the photos and details below. Clean space that’s move-in ready. Reach out for a tour or more info.

Address: 887-889 N Douglas St, El Segundo, CA

RSF: 7,369 (quick breakdown: 1 office, 2 conference rooms, 1 kitchen, 1 large open space for desks, lab space with a garage door; space is fully HVAC)

Rent: $3.75 per SF, Modified Gross

Term: Through August 31, 2027

Available: 60 days

Parking: 30 unreserved spaces at no cost

887-889 N Douglas St, El Segundo, CA (image: Costar)

Interior pics of the 887-889 N Douglas St sublease opportunity. (image: Costar)

A SPACE DIRT GATHERING, INVITE TO RSVP:

I’ve already gotten a humbling number of RSVPs, and I know plans can change, but if there’s a chance you may stop by, please RSVP via the below invitation.

I’m really looking forward to putting some faces with names. See everyone soon!

Details: December 11 @ 5pm at CREA’s offices.

NOTABLE FUNDINGS

Merlin Labs announced an upsized PIPE investment of more than $200 million (from $125 million initially announced in August 2025), of which over $85 million has already been funded. The increase comes from both new investors and existing investors increasing their commitments ahead of Merlin's Business Combination with Inflection Point Acquisition Corp. IV (Nasdaq: BACQ), expected to close in early 2026. Merlin develops aircraft-agnostic, AI-powered autonomous flight technology for defense and civil applications. The company has $100M+ in awarded contracts from military customers and is working with GE Aerospace and Northrop Grumman. (source: BusinessWire)

Ursa Major announced that it closed $100 million in its Series E funding round and received an additional $50 million in debt funding commitments. Investors include both new and long-term supporters of Ursa Major’s mission, including Eclipse, which led the round and was joined by Woodline Partners, Principia Growth, XN, and Alsop Louie Partners, among other institutional shareholders. Ursa Major also announced more than $115 million in bookings through the first three quarters of 2025, which includes both government and commercial partnerships with the U.S. Department of Defense, U.S. Air Force Research Laboratory, Stratolaunch, and BAE Systems. The fundraise will support Ursa Major’s business goals of scaling manufacturing and production across product lines. Ursa Major is using this investment to address urgent needs in the U.S. industrial base for modernized solutions that can deliver capabilities faster and more affordably than what legacy providers can supply. The Company will rapidly field its throttleable, storable, liquid-fueled hypersonic and space-based defense solution, as well as scale its solid rocket motor and sustained space mobility manufacturing capacity. (source: Ursa Major)

SF Compute, a San Francisco-based startup, has raised $40 million in equity funding to expand its AI compute marketplace. The Series A round values the company at $300 million, highlighting investor demand for new ways to finance infrastructure behind large models. SF Compute aims to let AI developers treat excess graphics processing unit capacity as a liquid asset instead of an inflexible cost. The $40 million round was led by DCVC and Wing Venture Capital, with participation from Electric Capital and Jack Altman’s Alt Capital. It follows an earlier $12 million raise, bringing SF Compute’s total funding to just over $50 million. DCVC general partner Ali Tamaseb, who has joined the board, has described the marketplace as an instant outlet for unused capacity that can keep operating even when valuations fall. (source: Startup Researcher)

Method Security has raised $26 million to deliver cyber resilience to the U.S. Government and critical enterprises. America is facing perpetual cyber conflict. With AI accelerating the speed and scale of attacks, U.S. cyber operators need new capabilities to stay ahead. Method is delivering those capabilities. Today, Method is deployed across the Defense Department, U.S. Federal Government, and Fortune 500. This funding accelerates Method’s mission to equip the security teams defending what matters most. It spans our seed and Series A, led by Andreessen Horowitz and General Catalyst, with participation from Blackstone, Crossbeam Venture Partners (Michael Ovitz), Forward Deployed Venture Capital, WndrCo, and Pax. (source: LinkedIn)

Quindar, the company powering autonomous and scalable mission control across hybrid space systems, announced it has raised $18 million in Series A funding led by Washington Harbour Partners, with continued investment from Booz Allen Ventures, FUSE, FCVC, and Y Combinator. The new capital will enable the company to develop a state-of-the-art classified facility in the Denver metro area to service multi-mission commercial and government programs, increase the number of commercial integrations, and expand its workforce. Quindar provides a common operating picture (COP) that automates the entire mission lifecycle—from planning and flight dynamics to command, control, and event management—so operators can achieve mission readiness faster and operate with resilience. (source: Quindar)

Flux Marine has closed a $15 million funding round to expand production of its electric outboard motors and powertrain technology. The Bristol, Rhode Island-based company reports leading North American deliveries of high-voltage electric outboards in 2024 and 2025, bringing total capital raised to over $30 million since 2020. (source: The EV Report)

Endolith, a U.S. biotech startup that aims to use AI to revolutionize the metals recovery process, announced it has raised $13.5 million in seed funding amid a growing national focus on critical minerals. This initial Series A funding was backed by investors with a national-security focus, with Baltimore-based Squadra Ventures leading the way. Also participating in the funding round were Draper Associates, Collaborative Fund and Overture Climate Fund. Endolith is currently developing an AI-guided process that uses microbes to extract copper and other critical minerals from low-grade and complex ores. This method, the Denver-based startup said, could offer a more environmentally friendly and potentially less cost-intensive alternative to conventional mining techniques. (source: Mining.com)

Orion announced $3.5 million in funding to expand its AI-powered risk intelligence platform that helps enterprises detect and respond to real-world threats before they escalate. The round was led by Dynamo Ventures, with participation from Bravo Victor Venture Capital, Techstars, and Service Provider Capital. Orion has also secured a government grant from Puerto Rico. (source: Tech Funding News)

Thermopylae’s interceptor during a test launch. (image: Thermopylae)

Thermopylae, a California-based interceptor drone startup launched in June by a 21-year-old Ukrainian engineer, announced it has raised $1.6 million in pre-seed funding. After building out the prototype with their first check from Founders, Inc., Thermopylae secured $1.6 million in pre-seed funding from prolific Silicon Valley investor Naval Ravikant and Ukraine-focused defense tech VC UA1, with participation from Norgard Capital and angel investors from SGA Capital, Cyrus Ventures, and others. The startup was founded by Yehor Balytskyi, a self-taught engineer who left Ukraine at 17 after Russia’s full-scale invasion in 2022. Balytskyi met his co-founder, Carter Scherer, in June and launched Thermopylae after a few successful national security hackathons. The team scored their first check from SF-based accelerator Founders, Inc. that month, demoing a working prototype to a handful of investors and soldiers in Nevada shortly after. (source: Tectonic)

Airheart Aeronautics announced its next round of funding to drive its mission to transform how pilots fly. This investment accelerates the rollout of its next-generation Airhart Aeronautics Avionics platform — a pilot-centric, intelligent flight-technology system built to make flying dramatically simpler, safer, and more intuitive. (source: LinkedIn)

AGREEMENTS, PARTNERSHIPS, & CONTRACTS

Voyager Technologies announced it acquired Estes Energetics, a supplier of solid rocket motors and energetic materials. The move underscores Washington’s push to rebuild domestic production lines for critical defense components. The Denver company, which recently went public, is a space and defense technology firm whose growth strategy now leans heavily toward national security programs. For Voyager, this latest acquisition secures long-term access to U.S.-sourced energetics. Estes is the country’s only producer of military grade black powder, a key ingredient used as an igniter in solid propellant systems. Voyager did not disclose the terms of the deal. The acquisition continues Voyager’s buying streak across propulsion, sensors, and space infrastructure. The company snapped up ElectroMagnetic Systems in August, adding artificial intelligence and machine learning tools for space-based radar, and acquired electric propulsion supplier ExoTerra Resources in October. Voyager says the combined portfolio is meant to support bids for major programs, including the Pentagon’s Golden Dome missile defense effort. (source: SpaceNews)

Ondas, a leading provider of autonomous aerial and ground robot intelligence through its Ondas Autonomous Systems (OAS) business unit and private wireless solutions through Ondas Networks, announced a $35 million strategic investment in Performance Drone Works (“PDW”), a veteran-led defense-technology engineer and manufacturer of advanced robotics for mission-critical national security missions. With this new investment from Ondas, PDW plans to:

Scale Production: Accelerate manufacturing and delivery to meet increasing demand for the C100 and AM-FPV platforms.

Significantly Increase Engineering Headcount: Expand capacity to accelerate product development and meet rising requirements across autonomy, payloads, and systems integration.

Acquire Critical Components: Continue to expand and fortify PDW’s domestically secure, NDAA-compliant supply chain.

PDW’s most recent contract is a $20.9 million award from the U.S. Army to supply its C100 UAS and Multi-Mission Payloads (MMP) in support of the Army's ‘Transformation in Contact’ (TiC) initiative. (source: Ondas)

X-Bow Systems is building its strategic partnership with Aeon, focusing on delivering capability at speed. Aeon's CEO and team visited X-Bow’s Luling, TX, manufacturing and test campus, where the collaboration centers around Aeon's Zeus Tactical Weapon System and X-Bow SRMs. XBow recently announced that it is preparing the Texas campus for SRM (Solid Rocket Motor) production. (source: LinkedIn)

Kraken’s K4 Manta. (image: Kraken)

UK-based USV company Kraken Technology Group announced that they’ve scored a coveted $49 million cap OTA with the United States Special Operations Command (USSOCOM) to develop and prototype “novel uncrewed surface and subsurface vessel technologies to enhance maritime capabilities for U.S. special operations forces.” This marks the first direct US contract for the company and a bit of a transatlantic coup in the ever-so-popular maritime autonomy space. “We are honoured to partner with USSOCOM in support of its mission to field disruptive maritime capabilities,” Mal Crease, CEO of Kraken, said in a statement. “This OTA represents a validation of our technology roadmap and underscores the critical need for next-generation uncrewed platforms.” (source: Tectonic)

Redwire was awarded a $44 million Phase 2 contract from DARPA to advance the Otter Very Low Earth Orbit (VLEO) mission to demonstrate the world's first air-breathing spacecraft. The Phase 2 contract provides funding to complete manufacturing and deliver the spacecraft to launch, which leverages Redwire's SabreSat platform. The spacecraft will use air-breathing electric propulsion (collects trace atmospheric molecules and feeds them into an electric thruster) to sustain flight in VLEO (90-450 kilometers altitude), which has traditionally been too low for long-duration missions due to atmospheric drag. DARPA awarded a $6.7 million contract in 2024 to Colorado-based Electric Propulsion Laboratory to supply the air intake and thruster package. DARPA has not disclosed a flight date. (source: Space News)

Saab has made a $10 million strategic investment in Pythom, a space technology company with Swedish roots, developing lightweight and rapidly deployable rockets designed to make space access more flexible, affordable, and resilient. The investment in Pythom supports Saab’s strategy to close capability gaps in the space domain, accelerate innovation in areas critical to national security, and strengthen Sweden’s space capabilities. This aligns with Saab's ambition to contribute to emerging global space-related defence requirements. (source: Saab)

CALSTART and the California Energy Commission (CEC) have awarded Anthro Energy a $5.5 million PowerForward: ZEV Battery Manufacturing Grant to establish the domestic production of advanced electrolytes and lithium-ion battery cells. The funding will support Anthro's California Production of Advanced Batteries for Zero Emission Vehicles (CPAB-ZEV) project, delivering state-of-the-art battery manufacturing capabilities to Alameda, CA by 2026. (source: PR Web)

Picogrid announced a new partnership with Deepnight, a company specializing in artificial intelligence (AI) video processing. The collaboration will integrate Deepnight’s software-defined night vision into edge sensors used for base defense and leverage Picogrid's Legion software as the central data and control layer. The companies have already won a $1.7 million Department of War (DoW) contract to prove the joint capability in critical infrastructure protection. The combined technology will significantly improve threat detection with low-cost cameras in low-light conditions, giving military operators superior situational awareness across bases. (source: PicoGrid)

Antares (microreactor developer) partnered with Manufacturo to establish nuclear-grade quality control and traceability from scratch. Antares is building adaptable, deployable microreactors for defense, space, and mission-critical infrastructure. The company needed to establish nuclear-grade quality without legacy systems, meeting standards that exceed most industrial programs: meticulous documentation, decades-long recordkeeping, and evolving compliance requirements. Manufacturo provided unified documentation, quality, and production control with built-in approval logic for safety-critical steps, personnel verification, and end-to-end traceability. The R1 reactor combines heat-pipe thermal management, TRISO fuel, and integrated shielding for compact, reliable energy generation. (source: Manufacturo)

HavocAI, the Rhode Island-based maritime autonomy startup, announced a partnership with SAIC to integrate the defense software mega-contractor’s Joint Range Extension (JRE) multi-domain communications and data system with Havoc’s fleet of unmanned surface vessels (USVs). (source: Tectonic)

REGENT Craft and DHL Express have partnered to explore the deployment of all-electric “Seaglider” vessels for cargo transport across regional and coastal trade lanes. The collaboration spotlights the pairing of REGENT’s next-generation Seaglider vessels with DHL’s express-cargo network. Initially, REGENT and DHL will focus on short-haul, coastal, and island-logistics applications in the Middle East, with a view to broader global deployment thereafter. According to the announcement, the collaboration will begin in January 2026. (source: Transport & Logistics)

Astrolab became the first company to sign an agreement with the Texas A&M Space Institute, securing space in their cutting-edge facility currently under construction at NASA's Johnson Space Center. The company is establishing a temporary HQ in Houston to serve as its base of operations while the Texas Space Institute facility is completed. Astrolab's local team is focused on advancing autonomous systems and developing new mission opportunities for lunar exploration. Under its current NASA Lunar Terrain Vehicle Services (LTVS) contract, Astrolab is collaborating with Houston-area partners, including Axiom Space and Odyssey Space Research, and working with Clear Lake-based Arrow Science and Technology to expand into new markets. (source: LinkedIn)

Rowden Technologies and Isembard announced a joint effort to scale sovereign UK manufacturing of advanced sensing systems for national security. The collaboration is part of Rowden's multi-million-pound investment in expanding sovereign production. Over the next 12 months, Rowden will create around 100 highly skilled roles across the Southwest, with Isembard manufacturing precision-engineered components to support Rowden's Magos product line (a family of sensing systems for government, defense, and national infrastructure). The partnership brings together Rowden's system design and in-house manufacturing expertise with Isembard's MasonOS-driven, software-defined production facilities. The initiative includes two-week hardware iteration cycles, investment in new UK production lines and automation, and expansion of skilled engineering roles. Rowden operates from 20,000 SF of engineering facilities in Bristol. (source: techSPARK)

Archer reached an agreement to expand its partnership with Anduril Industries beyond its joint hybrid-electric defense aircraft project. Archer will now also supply Anduril and EDGE with its dual-use electric powertrain technology to accelerate the development and scaled production of Anduril’s recently unveiled Omen Autonomous Air Vehicle system. This marks the first time Archer will make its proprietary advanced powertrain technology, in use on its Midnight eVTOL aircraft, available to a third party, introducing a new revenue stream to our business. Omen is Anduril’s hover-to-cruise Autonomous Air Vehicle, to be co-developed and co-produced by Anduril and EDGE Group for the UAE, which has committed to an initial acquisition of 50 Omen systems, creating an established demand signal for the Omen system and Archer’s powertrain technology. (source: LinkedIn)

Drone visual navigation startup Vermeer announced a partnership with Sentry Operations, a low-profile terminal guidance and precision effects company. The two firms say they will work together to develop a full-stack, localized, and autonomous navigation platform for strike drones in EW-dense environments. (source: Tectonic)

Aeon is teaming with Moog to integrate its advanced missile systems with its proven turrets and remote weapon stations. With more than 70 years of defense heritage, Moog’s combat-proven turrets are already deployed across U.S. and allied platforms, making them a seamless, plug-and-play integration of Aeon’s systems. (source: LinkedIn)

Orbital Robotics has signed an LOI with Space Copy to partner on lunar infrastructure and robotics. As Space Copy develops additive manufacturing systems for lunar and orbital environments that enable in-situ utilization of lunar regolith and orbital debris, Orbital Robotics is providing the robotic systems capable of gathering regolith, debris, and assembling systems from Space Copy’s manufactured components. While space debris is often viewed as a hazard, Orbital Robotics is reframing the problem as a large untapped resource in orbit. By combining Orbital Robotics’ debris-capturing and on-orbit assembly capabilities with Space Copy’s manufacturing systems, the two companies aim to unlock a scalable, economic pathway for large-scale construction in space. (source: LinkedIn)

CX2 has been successfully selected for Defense Innovation Unit (DIU) Project G.I. Design Reference Mission 2 (Accelerate the Kill Chain), with Vadris, an RF-seeker for FPV drones, following extensive testing and evaluation with U.S. military units. Vadris is an RF-seeking payload designed to find and fix adversary drone pilots and ground control stations. For the downselection, Vadris was integrated with a Neros Technologies Archer FPV drone, demonstrating survivability in denied and degraded environments throughout a variety of test scenarios. (source: LinkedIn)

WHAT I’M CONSUMING (AND ENJOYING!)

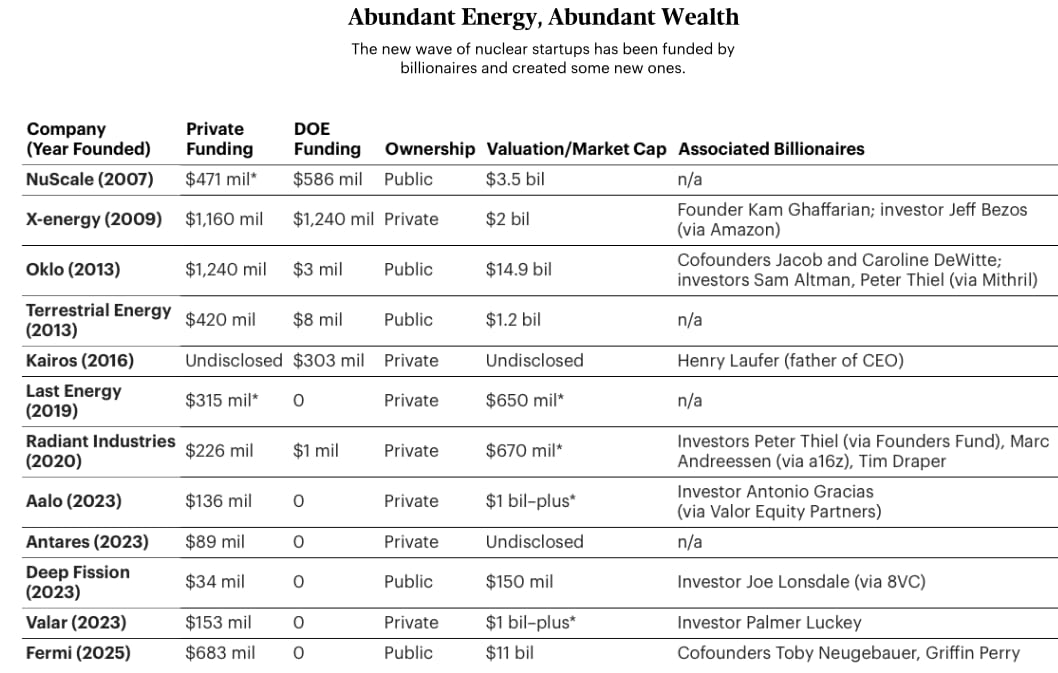

☢︎ Aalo Atomics is prominently featured in this Forbes article on the nuclear race. A dozen startups are betting AI's power hunger saves the nuclear industry. Electricity demand is soaring, largely because of the power-sucking data centers undergirding the artificial intelligence boom, and Aaolo’s Co-founder and CEO, Matt Loszak, isn’t the only nuclear entrepreneur aiming to ride the wave of AI dollars. A dozen ventures with names like Valar Atomics, Oklo, Kairos Power, and X-energy are racing to perfect, permit, and deploy a new generation of small, prefabricated reactors that could power individual data centers or even feed the larger electrical grid.

🛩 If you like startup origin stories, check out this one on Poseidon Aerospace, The Sea Monster that Flew, from the May issue of Arena Magazine.

📰 In his latest Substack, Nathan Mintz dismantles the recent Anduril hit pieces, pointing out the flaws and shares some history to illuminate why Anduril and others must continue to push the limits in their testing if the U.S. DoW is going to succeed in modern warfare.

HOW I CAN HELP YOU

Here are 3* ways I can help when the time is right:

Find a new home for your growing business. You're scaling fast, and you don't have time to become a CRE expert. I do this every day.

Sublease your space. Outgrown your office, but don't want to pay two rents? I'll help you find a subtenant.

Negotiate your lease renewal. Want to make sure you’re getting a fair deal from your Landlord? In my experience, you can never be too sure. Start 12 months out, so you're not scrambling at the last minute.

Strong references available. Let's talk.

*Not an exhaustive list 💪

Thanks for reading.

If you’d like your office and/or manufacturing space or business profiled - or even your city! - let me know. It’s always fun to explore and share the different components of the hard tech industry.

Erik Stiebel

Founder and Vice President

CA DRE License #02080746

424.241.4795 | [email protected]

Follow me on 𝕏

Reply