- Space Dirt

- Posts

- October's Space Dirt 🚀 (mid-month)

October's Space Dirt 🚀 (mid-month)

Where commercial real estate meets hard tech

In this issue… we have:

7 real estate highlights

3 companies emerging from stealth

8 fundings

3 agreements, partnerships & contracts

4 pieces of content I think you might enjoy…

And a whole lot more.

Enjoy!

REAL ESTATE HIGHLIGHTS

Smack Technologies leased 6,600 SF at 2201 Park Pl in El Segundo, CA. (source: Me!)

Rockwell Automation leased 7,620 SF at 1720 E Holly Ave, El Segundo, CA. (source: Me!)

Hadrian leased a building in Torrance, CA. (image: Costar)

Impulse Space leased 103,200 SF at 2425-2477 Manhattan Beach Blvd, Redondo Beach, CA. (source: Me!)

Solideon has opened a new production facility in Norfolk, VA, in partnership with Fairlead. The facility aims to strengthen the U.S. submarine industrial base by providing deployable and resilient production capacity. (source: LinkedIn)

STEALTH NO MORE

Critical Energy emerged from stealth via a LinkedIn post from its founder, former SpaceX engineer Spencer Jackson. Critical Energy builds modular, turbine-based grid-scale power generation systems perfect for accelerating the build time and reducing the cost of geothermal energy, as well as other energy types.

San Francisco, CA-based Fabrion, the latest company from 8VC’s Build Program, is transforming how industrial manufacturers and suppliers engage with complex, multi-tiered global value chains. Fabrion's full-stack, AI-native platform transforms data from pre-production, production, and post-production systems into real-time insights and actions. Fabrion’s founding team: Co-founder & CEO Roy Ng, Co-founder & CPO Christian V. Jordan, and Co-founder & CTO Kunal B.

New York City-based Root Access recently emerged from stealth and was featured in an AtomsNotBits profile. Root Access is an AI-native developer platform for programming hardware. It is bringing embedded systems tooling into the AI era with their flagship product, “Hideout,” the first universal IDE for programming hardware. At its core, Hideout enables embedded engineers to power through deeply technical workflows faster in a handful of ways. Root Access also announced it has raised a $2.1 million pre-seed led by AlleyCorp, an investor that deploys capital across deep tech, among other themes. A few of Alley Corp’s notable investments include Valar Atomics (nuclear), Viam (robotics), and Aon 3D (industrial 3D printing). Abe Murray (GP) and Brannon Jones (principal) were both engineers prior to venture. Additional investors include Forum Ventures, Gold House Ventures, Purdue Angels, Mana Ventures, Garuth Acharya, Arpan Ajmera, Marshall Singer, and active personnel in the DOD who requested to remain anonymous for security purposes. Ryan Eppley is the CEO and a Co-founder. (source: LinkedIn)

Join over 2,300 of the best & brightest in the hard tech community and subscribe to the only commercial real estate hard tech newsletter, Space Dirt!

REAL ESTATE CORNER

Unfortunately, I know some of you are already familiar with these deal killers. For the uninitiated, here’s what to watch out for when searching for your next space ⬇︎.

NOTABLE FUNDINGS

Base Power has raised $1 billion in its latest Series C funding round, earning a valuation of $3 billion according to the New York Times. The Texas-based power company hopes to build out accessible home batteries that will also help support the U.S. energy grid. The funding round was led by venture capital investor Addition, with continued backing from Trust Ventures, Valor Equity Partners, Thrive Capital, Lightspeed, Andreessen Horowitz, and others. New investors include CapitalG, Ribbit, BOND, Lowercarbon, and Spark. (source: Yahoo! Finance and LinkedIn)

Stoke Space announced it has raised $510 million in Series D funding led by Thomas Tull’s US Innovative Technology Fund (USIT) in conjunction with a $100 million debt facility led by Silicon Valley Bank. This new financing, which more than doubles its total capital raised to $990 million, will accelerate product development and expansion. The round also drew support from Washington Harbour Partners LP and General Innovation Capital Partners, underscoring Stoke’s importance to national security and the U.S. industrial base. Existing backers who also participated include 776, Breakthrough Energy, Glade Brook Capital, Industrious Ventures, NFX, Sparta Group, Toyota Ventures, Woven Capital, among others. (source: Stoke Space)

HavocAI raised $85 million in new funding. To date, it has raised just shy of $100 million. Notable investors of the most recent round include: B Capital, Scout Ventures, Lockheed Martin Ventures, IQT, and Hanwha Group. (source: LinkedIn)

Odys Aviation, a dual-use aviation company building hybrid-electric vertical take-off and landing (VTOL) aircraft, announced the closing of its $26 million Series A funding round. Led by Nova Threshold and with investment from Tuchen Ventures and key insiders, the capital will be used to accelerate U.S. full-scale aircraft flight testing of its Laila aircraft and to expand the team as the company prepares for its first international global launch operations, launching in Q1 2026. (source: BusinessWire)

Quilter announced a $25 million Series B to accelerate electronics design with physics-driven AI. The round is led by Index Ventures, with Nina Achadjian joining our Board. We’re fortunate to continue working with exceptional partners – from Benchmark Partner and Series A Lead Eric Vishria to hardware pioneer Lip-Bu Tan. (source: Quilter)

Flow Engineering announced a $23 million Series A led by Sequoia, joined by Patrick & Collison (Stripe), David Helgason (Unity), Kyle Parrish (Figma), and Alastair Mitchell (Odyssey). “Flow is the default requirements tool for the next generation of hardware companies. We power teams to design, test, and iterate as quickly as software.” (source: X)

Former SpaceX-er Jamie Gull founded a new early-stage deep tech fund, Wave Function Ventures. Just last week, he closed Wave Function’s first fund of $15.1 million, and he’s already off and running. Gull has made nine investments in startups that span industries like nuclear energy (Deep Fission), humanoid robotics (Persona AI), and, of course, aerospace (Airship Industries). He told TechCrunch he expects to do about 25 seed or pre-seed investments out of this fund. (Gull declined to name the anchor LP, and said the rest of the fund was filled by high-net-worth individuals, with support from other funds and “large family offices.”) (source: TechCrunch)

Energy Robotics, the leading AI software platform for autonomous inspection with robots and drones, announced the successful close of $13.5 million of Series A funding. Energy Robotics has completed over one million inspections across five continents, saving 32,000+ hours of hazardous human labor for customers across oil and gas, industrial, chemical, and utility sectors, including Shell, BP, Repsol, BASF, Merck, and E.ON. The Series A was co-led by Blue Bear Capital and Climate Investment (CI), with participation from Futury Capital, Hessen Capital, Kensho VC, and TADTech. The funding will accelerate the commercial deployment of Energy Robotics’ software across energy, chemicals, industrial, and security sectors. (source: Energy Robotics)

AGREEMENTS, PARTNERSHIPS, & CONTRACTS

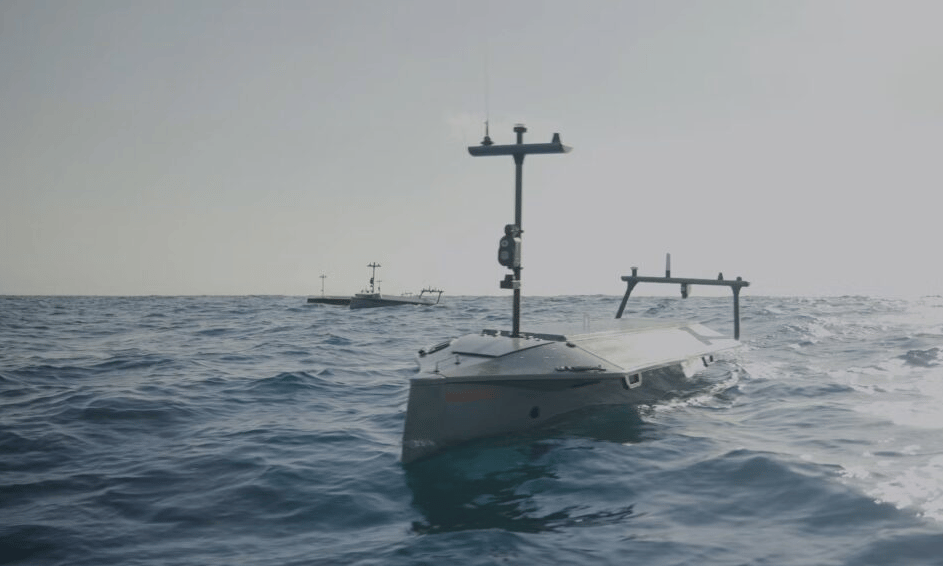

Lightfish USV. (image: Seasats)

Seasats, a San Diego-based small unmanned surface vessel (sUSV) startup, announced that it’s snagged an $89 million ceiling SBIR Phase 3 indefinite-delivery/indefinite quantity (IDIQ) contract with the Navy to deliver its Lightfish USVs to the Marine Corps. The Navy IDIQ, awarded in late September through the Naval Information Warfare Center Atlantic, includes a $70.7 million ceiling firm-fixed-price five-year ordering period, though only $2 million was obligated at award for the first delivery. If the Navy really takes a liking to the Lighfish, the contract features a two-year option period, which, if exercised, runs through 2032 and brings the total contract ceiling to $89 million. (source: Tectonic)

The U.S. Space Force awarded Blue Origin a $78.2 million contract to expand satellite processing capacity at Cape Canaveral Space Force Station. The three-year agreement was secured through a “Commercial Solutions Opening” (CSO) competition — a procurement method the government uses to attract private-sector innovation and share project costs with commercial partners. Building ground infrastructure at the nation’s busiest spaceport is needed to keep up with surging launch demand, officials said. (source: Space News)

Quantum Space has acquired Phase Four’s multi-mode propulsion assets. This breakthrough technology allows a single system to operate in both high-thrust chemical and high-efficiency electric modes, unlocking new levels of maneuverability, persistence, and mission flexibility for our Ranger spacecraft. The acquisition also includes a cutting-edge integration and test facility in Los Angeles, accelerating our ability to deliver agile, cost-effective platforms for a wide range of national security, civil, and commercial missions from LEO to GEO and cislunar space. (source: Quantum Space)

WHAT I’M CONSUMING (AND ENJOYING!)

📺 The CEOs of Epirus & Galvanick were on Sourcery (see YouTube ⬆︎) discussing the future of defense & cybersecurity.

📖 Cantos Partner, Grant Gregory, released The State of Adventure Capital via his LinkedIn. Here’s a link to the 286-page deck.

📈A case study from my client Cofactr showing how they transformed Farcast's supply chain processes and saved them over 100 hours a month, and have a 20% faster PCB build completion rate. Farcast (formerly UTVATE) builds advanced satcom user terminals.

📝 Smack Technologies Founder and CEO, Andy Markoff, started a Substack. His first entry, Three Letter Word, is a good read (IMHO) and a call for the Marines to modernize their inventory system… I think.

HOW I CAN HELP YOU

Some people only know me as “that Space Dirt newsletter guy.” Although I love that moniker, here are 3* ways I can help with your hard tech real estate when the time is right.

A new home for your growing business. The good news - you’re growing! The bad news - you need to move, and you don’t know the hard tech real estate market. I can help. And I come with strong references.

Sublease your space. You’ve outgrown your space and need to move, but don’t want to pay two rents? I got you.

Time to renew your lease? Want to make sure you’re getting a fair deal from your Landlord? In my experience, you can never be too sure. (BTW, I recommend starting the lease renewal process 12 months out at a minimum.)

*Not an exhaustive list 💪

Thanks for reading.

If you’d like your office and/or manufacturing space or business profiled - or even your city! - let me know. It’s always fun to explore and share the different components of the hard tech industry.

Erik Stiebel

Founder and Vice President

CA DRE License #02080746

424.241.4795 | [email protected]

Follow me on 𝕏

Reply