- Space Dirt

- Posts

- January's Space Dirt 🚀 (month-end)

January's Space Dirt 🚀 (month-end)

Where commercial real estate meets hard tech

This Space Dirt has the most variety of any I’ve ever published:

Real estate highlights

Companies emerging from stealth

The latest Socal Hard Tech Landscape Map

A Founder interview

Funding news

And a whole lot more.

Hope you enjoy.

-Erik

REAL ESTATE HIGHLIGHTS

Antares leased the other half of its Torrance building. (image: Costar)

Senra Systems leased 81,554 SF at 6100 Chip Ave, Cypress, CA. (source: LinkedIn)

Anduril is investing $1B to build a 1.18 million SF campus spanning Long Beach and Lakewood, creating ~5,500 direct jobs with mid-2027 opening. The Long Beach campus will span across six buildings, combining 750,000 square feet of office space with 435,000 square feet of industrial space dedicated to research and development. The facility will include labs, prototype manufacturing, and space for engineers/developers and will be located 30 minutes from Anduril’s Costa Mesa HQ and 90 minutes from the Capistrano test site. This follows their $1B Arsenal-1 plant in Ohio. (source: LA Times and Anduril)

Kratos Defense & Security Solutions announced the grand opening of its new 55,000-SF hypersonic and “Other” system manufacturing and payload integration facility in Princess Anne, MD. The advanced facility will significantly enhance Kratos’ capabilities to support launch operations and hypersonic testing for the Multi-Service Advanced Capability Hypersonics Test Bed (MACH-TB) 2.0 program and other customers from agencies including the U.S. Navy, US Air Force, DARPA, and the Missile Defense Agency. The location was strategically chosen for its proximity to NASA Wallops Flight Facility, optimizing logistics and operational efficiencies. This is Kratos’ sixth new facility in a year. (source: Kratos Defense)

Oracle is building a data center at Project Jupiter, a world-class AI data center campus in southern New Mexico that will bring high-quality jobs, sustainable infrastructure, and long-term economic benefits to Doña Ana County while strengthening America’s position in the global AI race. Oracle will occupy the campus once construction is complete, deploying the latest AI infrastructure for its customer, OpenAI. (source: Oracle)

STEALTH NO MORE

Bulwark Dynamics emerged from stealth, developing autonomous landing craft for contested maritime environments. The Menlo Park-based company was founded by Nhat Lieu to address the logistics challenge of moving critical assets in environments where long-range precision strikes and pervasive sensing punish traditional large platforms. The company is completing its first prototype, the Caravel 15X - a 17-foot autonomous vessel designed for repeated beach landings across mixed terrain (sandy and rocky shorelines) while carrying a 6,600-pound payload equivalent to two Joint Modular Intermodal Containers (JMICs). Core capabilities include autonomous navigation to shorelines and rapid cargo offload to minimize exposure during vulnerable littoral operations. The platform aligns with Expeditionary Advanced Base Operations (EABO) concepts for distributed, mobile, low-signature sustainment operations. Initial demonstrations are planned for March-April 2025. The company established its Menlo Park base to accelerate prototype development and U.S. government engagement, integrating engineering, testing, and partner collaboration in one location as they transition from development to operational validation. Funding details and investor information not disclosed. (source: LinkedIn)

Ambral (YC S25) emerged from stealth with an oversubscribed pre-seed round to build AI-powered customer account management systems. The New York-based company was founded by Sam Brickman (CEO, 2x founder with 1 exit) and Jack Stettner (CTO, ex-SpaceX Flight Software Special Projects). Brickman was an early product hire at Wonder (0 to $50M revenue, now valued at $7B) and led AI product at Everlywell, while personally handling customer support across 167 countries and delivering breakfast at 4am to maintain customer intimacy. Stettner developed telemetry routing and analysis systems for SpaceX's Falcon 9 and Falcon Heavy, working on next-gen flight computers and watching how split-second decisions in mission control determine success or failure. Ambral's "Cortex" platform synthesizes signals from all customer activity and interactions into AI-powered models of every account, pinpointing who needs attention and why while autonomously executing strategic actions to drive expansions and prevent churn. The system uses Claude Agent SDK with dedicated sub-agents for each data type (usage data, Slack messages, meeting transcripts, product interactions) to solve the problem of account managers juggling 50-100 accounts simultaneously. The company is already deploying inside multi-billion dollar enterprises and has moved into a new NYC office. Funding amount not disclosed. (source: Y Combinator, LinkedIn)

Caleb Ho, Founder of Blitzpanel.

Blitzpanel emerged from stealth to build software-enabled manufacturing for industrial control panels. The company was founded by Caleb Ho after years of designing and shipping industrial systems, which revealed the broken state of panel design workflows. Traditional panel building involves 8-10 week lead times, back-and-forth quoting over email and drawings, and small changes that reset the entire process. Blitzpanel's platform allows engineers to design panels online through Blitzpanel Studio or upload requirements to get instant quotes, then automatically builds assemblies with built-in UL508A compliance rules for standardized labeling. The company handles the complete workflow from design through wiring, testing, and shipping panels ready to install. Blitzpanel is already shipping to industrial startups and advanced manufacturing teams, with early pilots converting to repeat orders. The vision is an on-demand, software-driven panel supply chain where teams go from requirements to built, tested panels in days instead of months. By digitizing documentation and automating manufacturing, the platform removes friction from traditional panel building while delivering faster lead times, higher reliability, and scalable factory capacity. Funding details and investor information not disclosed. (source: X)

Gambit AI emerged from stealth to build coordination software for multi-domain autonomous systems across air, ground, and sea platforms. The dual-use company was founded in 2023 by CEO Josh Giegel (ex-Virgin Hyperloop co-founder and CTO, ex-SpaceX) and Chief Commercial Officer Ben Richardson to create seamless coordination between machines regardless of brand or builder. Giegel's vision draws from "The Matrix" Trinity helicopter scene - enabling instant access to any autonomous capability through software. The company has secured partnerships with major defense contractors, including AWS, L3Harris Technologies, RTX, and Sierra Nevada Corporation, plus Pentagon contracts and participation in U.S. military exercises with the Army and Special Operations Command (sometimes serving as the red team flying against military systems). H.R. McMaster serves as an advisor. Gambit's platform promises the "highest level of autonomy" with systems that can learn, adapt, and collaborate "as a single brain" to address the military's challenge of autonomous systems that can't interoperate or adapt to sudden frontline changes. The team combines experience from the Pentagon, Defense Innovation Unit, Marine Corps, Air Force, SpaceX, Unity, and Virgin Hyperloop. Backed by Eclipse and Marlinspike among other investors, with Eclipse partner Aidan Madigan-Curtis noting the next 12-24 months will demonstrate DoD's shifting procurement toward companies like Gambit. Funding amount not disclosed. (source: Axios, LinkedIn)

Voxel Energy emerged from stealth to build data centers with onsite power generation using second-life EV batteries. The Y Combinator company was founded by ex-Tesla engineers Casey Spencer, Evan Schmidt, and Max Pfeiffer, along with data center construction managers with commercial EV manufacturing recognition. Voxel addresses the $3 trillion in data center projects slated for construction by 2030, where half may never be built due to power grid constraints. The company bypasses grid limitations by leveraging the expanding pool of second-life EV batteries to build energy storage capacity into hundreds of megawatt-hours, coupled with solar and a novel DC microgrid architecture for grid-scale power without grid-scale delays. This enables data center commissioning in months rather than years, unlocking billions in pull-in revenue for the AI boom. Voxel's systems are already live and operational, running off-grid compute with batteries being amassed to accommodate demand and hundreds of acres under contract. The company is now taking reservations for existing sites with limited capacity available. Funding details and investor information not disclosed. (source: LinkedIn, Voxel White Paper)

UPDATED: SOCAL HARD TECH LANDSCAPE MAP

Thanks for your help in updating this map. If you’d like a PDF, reach out.

As a reminder, I don’t include the primes. Also, you’ll notice several companies appear under more than one city. I thought it’d be interesting to truly represent the hard tech footprint in the region.

243 hard tech companies on this map.

REAL ESTATE CORNER

INTERVIEW: FOUNDER FIVE

In case you missed it, Space Dirt launched a new interview series, The Founder Five. In our first edition, we interviewed EraDrive’s Cofounder & CEO, Sumant Sharma.

In December, EraDrive closed an oversubscribed seed round, totaling $5.3 million. For context, basically, EraDrive makes spacecraft self-driving.

Here’s one of my favorite answers from Sumant:

Space Dirt: What’s your approach to building your team and company culture in the hard tech space?

Sharma: We are building an intentional mix of people with deep experience from large, conventional aerospace missions, people who have built and operated in new space, researchers from academia who bring cutting-edge methods, and engineers from adjacent autonomy industries like autonomous driving, aviation, and robotics. Each group contributes a distinct strength, whether it is mission assurance discipline, speed to flight, frontier algorithms, or productizing perception and decision systems at scale. Our culture is designed to take the best from each domain: high ownership, direct communication, and rigorous engineering practices that let us move quickly while still building systems that can be trusted in orbit.

To read the full interview, click below.

NOTABLE FUNDINGS

Skild AI raised $1.4B. The investment was led by SoftBank with participation from NVentures (NVIDIA), Macquarie Capital (entities administered by Macquarie Capital), and Jeff Bezos (via Bezos Expeditions), catapulting its valuation to over $14 billion. Lightspeed, Felicis, Coatue, and Sequoia Capital have doubled down on their investments. Several strategic investors have also come on board, including LG, Schneider Electric, CommonSpirit, and Salesforce Ventures. Other investors include Disruptive, 1789 Capital, IQT, TF Capital, Andra Capital, Palo Alto Growth Capital, Alpha Square, Mirae Asset, and Destiny. (source: Skild AI)

Zipline raises $600M+ at a $7.6B valuation, surpassing 2,000,000 commercial deliveries and becoming the world’s largest commercial autonomous delivery system. Zipline’s latest funding round included participation from several existing and new investors, including Fidelity Management & Research Co., Baillie Gifford, Valor Equity Partners, and Tiger Global. The company said it plans to use the capital to accelerate its expansion into at least four new states this year. Houston and Phoenix are the first two markets on that journey. (source: Molly O’Shea and The Robot Report)

Standard Nuclear, a reactor-agnostic producer of TRISO nuclear fuel, announced it has secured $140M in Series A funding from investors led by Decisive Point with participation from new investors Chevron Technology Ventures, StepStone Group, XTX Ventures, and existing investors Welara, Fundomo, Andreessen Horowitz, Washington Harbour Partners, and Crucible Capital, among many others. This latest capital raise will support Standard Nuclear’s rapid buildout of new fuel development and fabrication infrastructure beyond the company’s existing operational and privately funded commercial-scale TRISO manufacturing line. (source: BusinessWire)

Mytra raised $120M Series C for software-defined warehouse robotics. The round was led by Avenir Growth, and included Kivu, Liquid 2, D.E. Shaw, Offline, plus existing Eclipse/Greenoaks for software-defined warehouse robotics. The company hit major scale in 2025: signed Fortune 100 food and Fortune 500 industrial customers, delivered 60x larger deployment than previous max, moved into 7x larger facility. The system uses 3D robotics to automate material movement/storage, claiming a 32% reduction in labor 34% improvement in storage density. (source: Mytra)

Northwood Space, a maker of phased-array ground stations, announced it raised $100M in Series B funding as government and commercial operators seek to expand satellite control capacity. The round was led by Washington Harbour Partners and co-led by a16z, with participation from Alpine Space Ventures and others. The financing comes nine months after the company announced a $30M Series A. Northwood builds electronically steered antennas that communicate with satellites without physically moving the antenna. CEO and co-founder Bridgit Mendler said the new funding follows a $49.8M contract award from the U.S. Space Force to augment the capacity of the Satellite Control Network. (source: SpaceNews)

Canadian lithium refining startup Mangrove Lithium has closed $85M in financing commitments to ramp up its tech. Mangrove raised $65M of the funds from Canada Growth Fund, a $15B public sector pension fund developed by the Canadian government to support tech in the country. Existing investors participated in the financing, including Breakthrough Energy Ventures and BMW i Ventures. The financing will be used to develop Mangrove's processing facility under construction in Delta, British Columbia, and to plan a larger facility in eastern Canada. (source: Axios)

Evan Painter, a founding member and head of design for LAND Moto, at the startup's Ohio City headquarters. (image: Crains Cleveland)

Cleveland-based LAND Moto (electric motorcycles + swappable batteries) is preparing a $50M Series B raise after completing a $7M Series A. Currently producing 30+ units/month of "The District" eMoto ($7K, four speed settings from e-bike to 70+ mph). Planning to scale to 100+ units/month with a $15M bridge round, then 15,000 units/year with Series B. Also pivoting into battery manufacturing for other OEMs, which would require doubling headcount from 22 to 40-50 people. (source: Crains Cleveland)

AheadComputing has raised $30M in a Seed2 round, bringing the company’s total funding to $53M to date. The round was co-led by Eclipse, Toyota Ventures, and Cambium, with additional participation from Corner, Trousdale Ventures, EPIQ, MESH, and Stata. This new capital will support enhancing R&D, software innovation, and test chip development. Additionally, AheadComputing continues to scale its team of nearly 120 people, which has collectively shipped 70+ products over the course of their careers. Founded by former Intel veteran Debbie Marr (35 years, led multiprocessor architecture), the company is targeting the CPU market that powers AI infrastructure, citing that every GPU board requires a CPU. They're pursuing RISC-V for its open standards and ability to iterate architecturally, with initial tapeout planned through TSMC. (source: AheadComputing)

Karman Industries disclosed a $20M Series A led by Riot Ventures in September 2025, bringing total funding to over $30M. Other major participants included Sunflower Capital, Space VC, Wonder Ventures, and former Intel and VMware CEO, Pat Gelsinger. (source: BusinessWire)

Grid Aero, an aerospace startup building low-cost, autonomous aircraft for long-range operations, today announced it has raised a $20M Series A co-led by Bison Ventures and Geodesic Capital, with participation from Stony Lonesome Group and Alumni Ventures, alongside returning investors Ubiquity Ventures, Calibrate Ventures, and Commonweal Ventures. Grid Aero designs rugged autonomous aircraft capable of carrying thousands of pounds over thousands of miles. (source: BusinessWire)

SkyFi, an AI-first Earth intelligence platform, today announced that it has raised a $12.7M in an oversubscribed Series A funding round. The round was co-led by Buoyant Ventures and IronGate Capital Advisors, with new participation from DNV Ventures, TFX Capital, Beyond Earth Ventures, Nova Threshold, and Chris Morisoli, and existing investors RSquared VC and J2 Ventures. This investment will accelerate product development and enhance SkyFi's technology, including its platform’s user interface and analytical tools. Additionally, the company plans to forge new partnerships with satellite operators to expand its on-demand data offerings and AI-enabled analytic capabilities for leading commercial and government customers worldwide. (source: SkyFi)

Samara Aerospace raised $10M seed led by Balerion Space Ventures (also Illinois Ventures, MFV Partners, Access Venture Partners) to develop satellite stabilization technology. Their "Hummingbird" satellite uses solar panel hinges for positioning instead of traditional reaction wheels, claiming 1,000x greater stability. Currently validating tech on Impulse Space's Mira spacecraft (launched Nov '25). Targeting EO imaging and optical comms markets, with the first Hummingbird sat planned for summer 2027. (source: Payload)

Titan Dynamics has raised a $9M seed round. This funding will be used to accelerate the development and delivery of advanced sUAS platforms, mobile sUAS factories and auto-generating UAS software built to adapt at the speed of the mission. Before this round, Titan Dynamics was bootstrapped for over 2 years. Investors included: Long Journey, Tamarack Global, NVTBL, Epakon Capital, Discipulus Ventures, HF0 Residency, Cherubic Ventures, Justin Caldbeck, and more. (source: LinkedIn)

Aule Space announced the closing of $2M in pre-seed funding to develop spacecraft that will be able to grapple onto existing sats in GEO (no preassembly required) and provide up to six years of extra propulsion. The round was led by pi Ventures with additional angel investment from former Intelsat board member Eash Sundaram, and Arvind Lakshmikumar, CEO of Tonbo Imaging, an Indian defense firm developing optical sensors. (source: Payload)

Join over 2,800 of the best & brightest in the hard tech community and subscribe to the only commercial real estate hard tech newsletter, Space Dirt!

AGREEMENTS, PARTNERSHIPS, & CONTRACTS

The Pentagon announced that it had awarded two contracts to Varda Space Industries and Stratolaunch as providers for Task Area 3 of the Multi-Service Advanced Capability Hypersonic Test Bed (MACH-TB) program, which focuses on reusable flight concepts for hypersonic missile tests. The two companies will each leverage their expertise to meet program goals.

Varda’s bringing its experience in building reentry vehicles to the table.

Stratolaunch will bring its air-launched hypersonics platform.

Under the contracts, the two companies will provide reusable test vehicles as well as launch services for the MACH-TB program. That means carrying out experiments and hypersonic tests with the goal of hardware reuse. (source: Payload)

The U.S. Department of Energy (DOE) has issued its first production-scale task orders under a $2.7B uranium enrichment program launched in 2024, awarding $900M each to Centrus Energy Corp., General Matter, and Orano Federal Services to expand domestic capacity for conventional low-enriched uranium (LEU) and high-assay low-enriched uranium (HALEU) over the next decade. The fixed-price orders mark a significant milestone in implementing a competitive contracting framework that the DOE established in 2024 to rebuild U.S. uranium enrichment capacity. (source: Power Magazine)

French satellite manufacturer Loft Orbital landed a nearly $58.6M contract from the French military to deliver the country’s first sovereign synthetic-aperture radar (SAR) capability. The demonstration is part of France’s DESIR program (translated to the Demonstrator of Sovereign Radar Imaging Elements), which is intended to widen the pool of EO capabilities available to the French defense sector. While other European nations—like Sweden and Germany—have opted to purchase SAR data or satellites directly from ICEYE, France is developing a custom-built solution. (source: Payload)

Seasats received $24M through the Department of War's APFIT program to accelerate production of its autonomous surface vessels. The award will scale manufacturing of their Lightfish ASV, which the Navy recently used for a record-setting transatlantic crossing. Seasats has expanded partnerships across DoD, including Task Force 59 (Middle East) and Task Force 66 (Europe), and recently launched new platforms, including the Quickfish interceptor and upcoming Heavyfish heavy-lift vessel. (source: PR Newswire)

The Space Force awarded Starfish Space, a WA-based space startup, a $52.5M contract to deorbit satellites in the SDA’s Proliferated Warfighter Space Architecture constellation, when the satellites reach their expiration date. Starfish says this marks the first contracted mission for end-of-life satellite disposal services, compared with typical missions that treat disposal as a one-off or a demo. Starfish is set to launch an Otter spacecraft—which can deorbit multiple sats in one flight—for the mission in 2027. Under the contract, DoD can keep buying services to take down defunct sats beyond the initial deorbit. (source: Payload)

Gecko Robotics partnered with Trident Maritime Systems to deploy robots, sensors, and AI software (Cantilever platform) across Trident's naval component manufacturing facilities. Expected to boost Trident output 40% by identifying bottlenecks in the supply chain for DDGs and submarines. Gecko uses climbing/crawling/swimming robots with ultrasonic sensors for infrastructure inspection—expanding from maintenance into manufacturing optimization. (source: Tectonic)

Astrobotic won three contracts totaling $17.5M to advance its reusable rocket systems. The awards include: $1.9M SBIR from Space Force/AFRL for Xodiac-B to flight test rotating detonation rocket engines, $1.6M NASA Phase III SBIR for Xodiac-C focused on entry/descent/landing testing with improved maneuvering and modular payload bay, and $14M NASA SBIR Phase III for Xogdor Block 1B—a suborbital variant capable of reaching above 100km with 200kg payloads and multiple flights per week. The Pittsburgh company has conducted over 625 reusable rocket flights across 5 vehicles and operates from Mojave Air and Space Port. (source: Astrobotic)

Redwire Corporation, a global leader in space and defense technology solutions, announced it was awarded a contract for the Missile Defense Agency Scalable Homeland Innovative Enterprise Layered Defense (SHIELD) indefinite-delivery/indefinite-quantity (IDIQ) contract with a ceiling of $151B. This contract encompasses a broad range of work areas that allows for the rapid delivery of innovative capabilities to the warfighter with increased speed and agility. (source: Redwire)

Galvanick has been selected for a prime IDIQ contract under the War Department’s $151B MDA SHIELD contract, part of Golden Dome. (source: LinkedIn)

WHAT I’M CONSUMING (AND ENJOYING!)

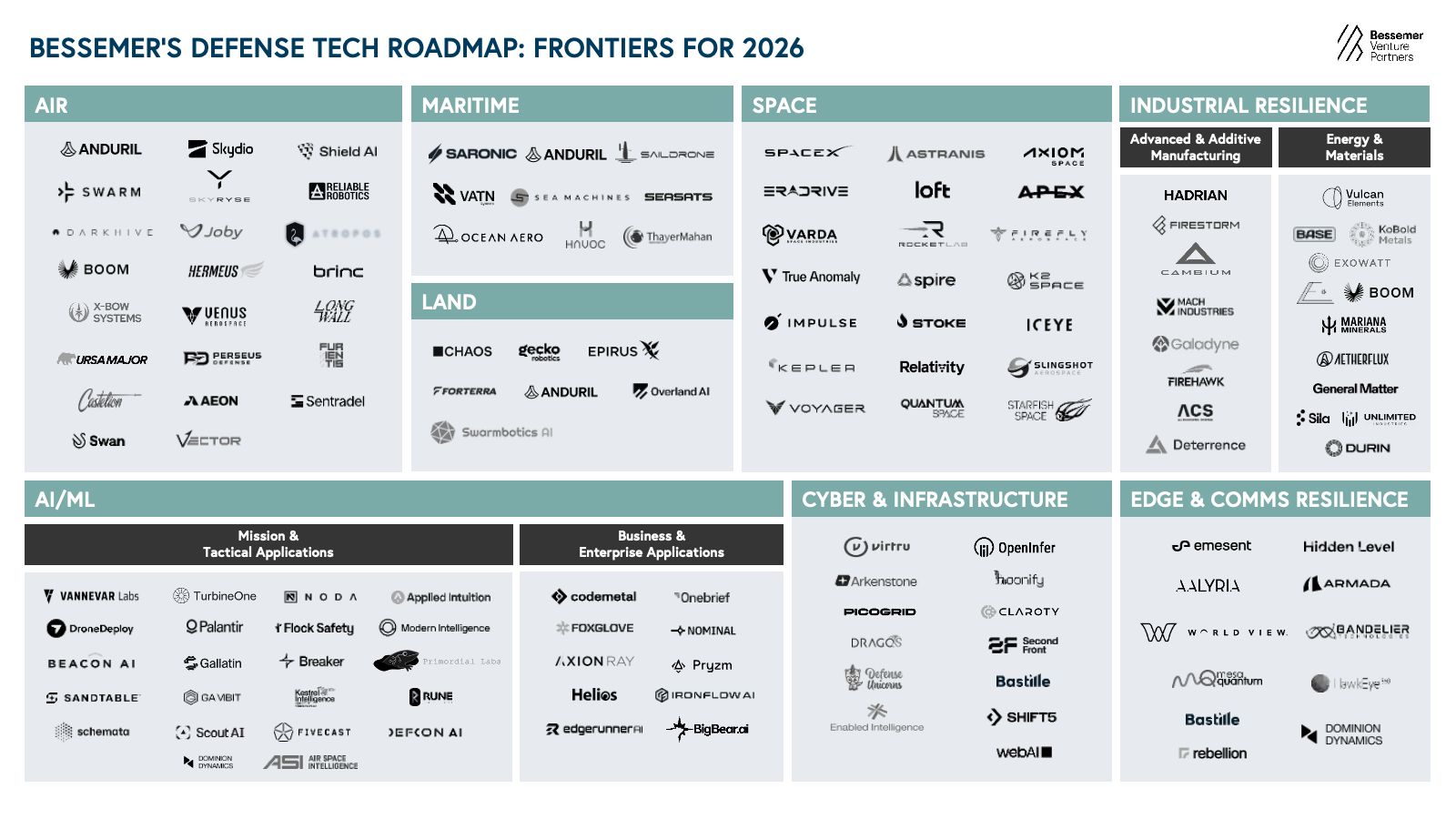

Bessemer Venture Partners identified five critical domains they believe will define the next generation of national security innovators in 2026, and put together their defense tech roadmap. A good read.

Upfront Ventures’ Jacques Sisteron released his annual LA Hard Tech 50, a list of LA's top 50 hard tech companies selected by 11 LA-based investors (Lux, Sequoia, Riot, CIV, Commodity Capital, MaC, Generational, Lowercarbon, Cantos, Upfront). Seven companies received unanimous votes: SpaceX, Anduril, Apex, Varda, Senra Systems, Radiant, and General Matter. Check out the rest of this list.

Four top Pentagon acquisition officials published an op-ed in response to Secretary Hegseth's declaration that "Acquisition is now a warfighting function." I thought this sentence summed it up nicely: For the first time in the 55 years of modern acquisition history, we’re not asking our acquisition workforce to minimize risk and avoid blame. (source: Breaking Defense)

(Above) AI is reshaping military decision-making. Smack Technologies Cofounder, Clint Alanis joins Robots and Red Tape to explain how their Omega and Alpha platforms deliver decision dominance — compressing cycles from weeks to minutes while maintaining human oversight.

Balerion Space Ventures pulled together the above chart showing how space, defense, and critical infrastructure stocks have vastly outperformed the market over the last 5 years.

Lastly, I’m not a tech person, but this seems promising given its implications for AI: Karman Industries introduced its Heat Processing Unit (HPU), a new category of thermal infrastructure for giga-scale AI. “We applied an aerospace systems-engineering approach to data center thermodynamics,” said CJ Kalra, CTO and Co-Founder. “Our team designed HPUs to process the extreme heat of gigascale racks using a first-principles-based approach. HPUs enable heat reuse and PUE ratings quickly approaching 1 without water consumption or PFAS chemicals for AI factories. Keeping up with the latest in technology, the HPU leverages 800V DC architecture while borrowing the latest innovations in rocket turbomachinery like metal 3D-printing, and electric vehicles innovations like high-speed motors & Silicon-Carbide power electronics technology." (source: BusinessWire)

HOW I CAN HELP YOU

Here are 3* ways I can help when the time is right:

Find a new home for your growing business. You're scaling fast, and you don't have time to become a CRE expert. I do this every day.

Sublease your space. Outgrown your office, but don't want to pay two rents? I'll help you find a subtenant.

Negotiate your lease renewal. Want to make sure you’re getting a fair deal from your Landlord? In my experience, you can never be too sure. Start 12 months out, so you're not scrambling at the last minute.

Strong references available. Let's talk.

*Not an exhaustive list 💪

Thanks for reading.

If you’d like your office and/or manufacturing space or business profiled - or even your city! - let me know. It’s always fun to explore and share the different components of the hard tech industry.

Erik Stiebel

Founder and Vice President

CA DRE License #02080746

424.241.4795 | [email protected]

Follow me on 𝕏

Reply